EXHIBIT 99.2

Published on April 25, 2024

Exhibit 99.2

0 First Quarter 2024 Earnings Results Presentation April 25, 2024

INVESTOR RELATIONS Marty Kropelnicki Chairman & CEO Today’s Participants 1 James Lynch Sr. Vice President, CFO & Treasurer Greg Milleman Vice President, Rates & Regulatory Affairs

INVESTOR RELATIONS Forward - Looking Statements This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 (“PSLRA”) . The forward - looking statements are intended to qualify under provisions of the federal securities laws for “safe harbor” treatment established by the PSLRA . Forward - looking statements in this presentation are based on currently available information, expectations, estimates, assumptions and projections, and our management’s beliefs, assumptions, judgments and expectations about us, the water utility industry and general economic conditions . These statements are not statements of historical fact . When used in our documents, statements that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could, estimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks or variations of these words or similar expressions are intended to identify forward - looking statements . Examples of forward - looking statements in this presentation include, but are not limited to, statements describing Cal Water’s expected financial performance, investments in infrastructure projects and PFAS treatment, GHG emissions reductions targets, and expectations regarding the business and financial impact of the 2021 GRC decision . Forward - looking statements are not guarantees of future performance . They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks . Consequently, actual results may vary materially from what is contained in a forward - looking statement . Factors that may cause actual results to be different than those expected or anticipated include, but are not limited to : our ability to invest or apply the proceeds from the issuance of common stock in an accretive manner ; governmental and regulatory commissions’ decisions, including decisions on proper disposition of property ; consequences of eminent domain actions relating to our water systems ; changes in regulatory commissions’ policies and procedures, such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs, which impacted the 2021 GRC ; the outcome and timeliness of regulatory commissions’ actions concerning rate relief and other matters ; increased risk of inverse condemnation losses as a result of climate change and drought ; our ability to renew leases to operate water systems owned by others on beneficial terms ; changes in California State Water Resources Control Board water quality standards ; changes in environmental compliance and water quality requirements ; electric power interruptions, especially as a result of public safety power shutoff programs ; housing and customer growth ; the impact of opposition to rate increases ; our ability to recover costs ; availability of water supplies ; issues with the implementation, maintenance or security of our information technology systems ; civil disturbances or terrorist threats or acts ; the adequacy of our efforts to mitigate physical and cyber security risks and threats ; the ability of our enterprise risk management processes to identify or address risks adequately ; labor relations matters as we negotiate with the unions ; changes in customer water use patterns and the effects of conservation, including as a result of drought conditions ; our ability to complete, in a timely manner or at all, successfully integrate and achieve anticipated benefits from announced acquisitions ; the impact of weather, climate change, natural disasters, and actual or threatened public health emergencies, including disease outbreaks, on our operations, water quality, water availability, water sales and operating results and the adequacy of our emergency preparedness ; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends ; risks associated with expanding our business and operations geographically ; the impact of stagnating or worsening business and economic conditions, including inflationary pressures, general economic slowdown or a recession, increasing interest rates, instability of certain financial institutions, changes in monetary policy, adverse capital markets activity or macroeconomic conditions as a result of the geopolitical conflicts, and the prospect of a shutdown of the U . S . federal government ; the impact of market conditions and volatility on unrealized gains or losses on our non - qualified benefit plan investments and our operating results ; the impact of weather and timing of meter reads on our accrued unbilled revenue ; the impact of evolving legal and regulatory requirements, including emerging environmental, social and governance requirements and our ability to comply with PFAS regulations ; and other risks and unforeseen events described in our Securities and Exchange Commission (“SEC”) filings . In light of these risks, uncertainties and assumptions, investors are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date of this news release . When considering forward - looking statements, you should keep in mind the cautionary statements included in this paragraph, as well as the Annual Reports on Form 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the SEC . We are not under any obligation, and we expressly disclaim any obligation to update or alter any forward - looking statements, whether as a result of new information, future events or otherwise . 2

INVESTOR RELATIONS Strong operating performance highlighted by resolution of the 2021 California Water Service (Cal Water) General Rate Case and Infrastructure Improvement Plan (2021 GRC) • Authorization to invest $1.2 billion in water system improvement projects (2021 - 2024) • Adoption of progressive rate design • Recognition of interim rates (FY 2023 - Q1 2024) Implementation in California of 10.27% return on equity $83 million in additional state funding to relieve California customers of past - due balances accumulated during the COVID - 19 pandemic New EPA PFAS regulation Commitment to reducing absolute Scope 1 and 2 greenhouse gas (GHG) emissions by 63% by 2035 First Quarter 2024 Highlights 3

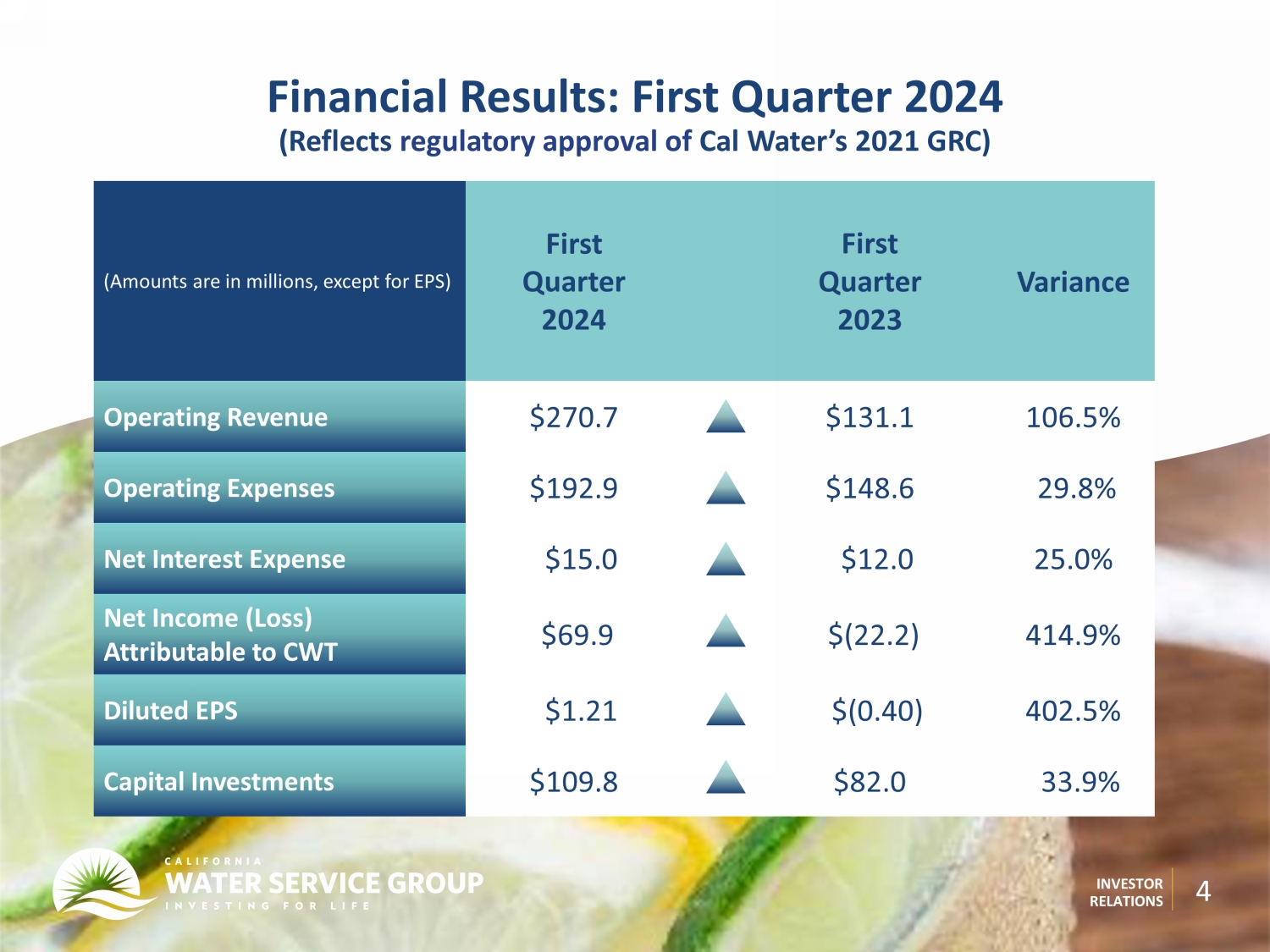

INVESTOR RELATIONS (Amounts are in millions, except for EPS) First Quarter 2024 First Quarter 2023 Variance Operating Revenue $270.7 $131.1 106.5% Operating Expenses $192.9 $148.6 29.8% Net Interest Expense $15.0 $12.0 25.0% Net In come (Loss) Attributable to CWT $69.9 $(22.2) 414.9% Diluted EPS $1.21 $(0.40) 402.5% Capital Investments $109.8 $82.0 33.9% Financial Results: First Quarter 2024 ( Reflects regulatory approval of Cal Water’s 2021 GRC) 4

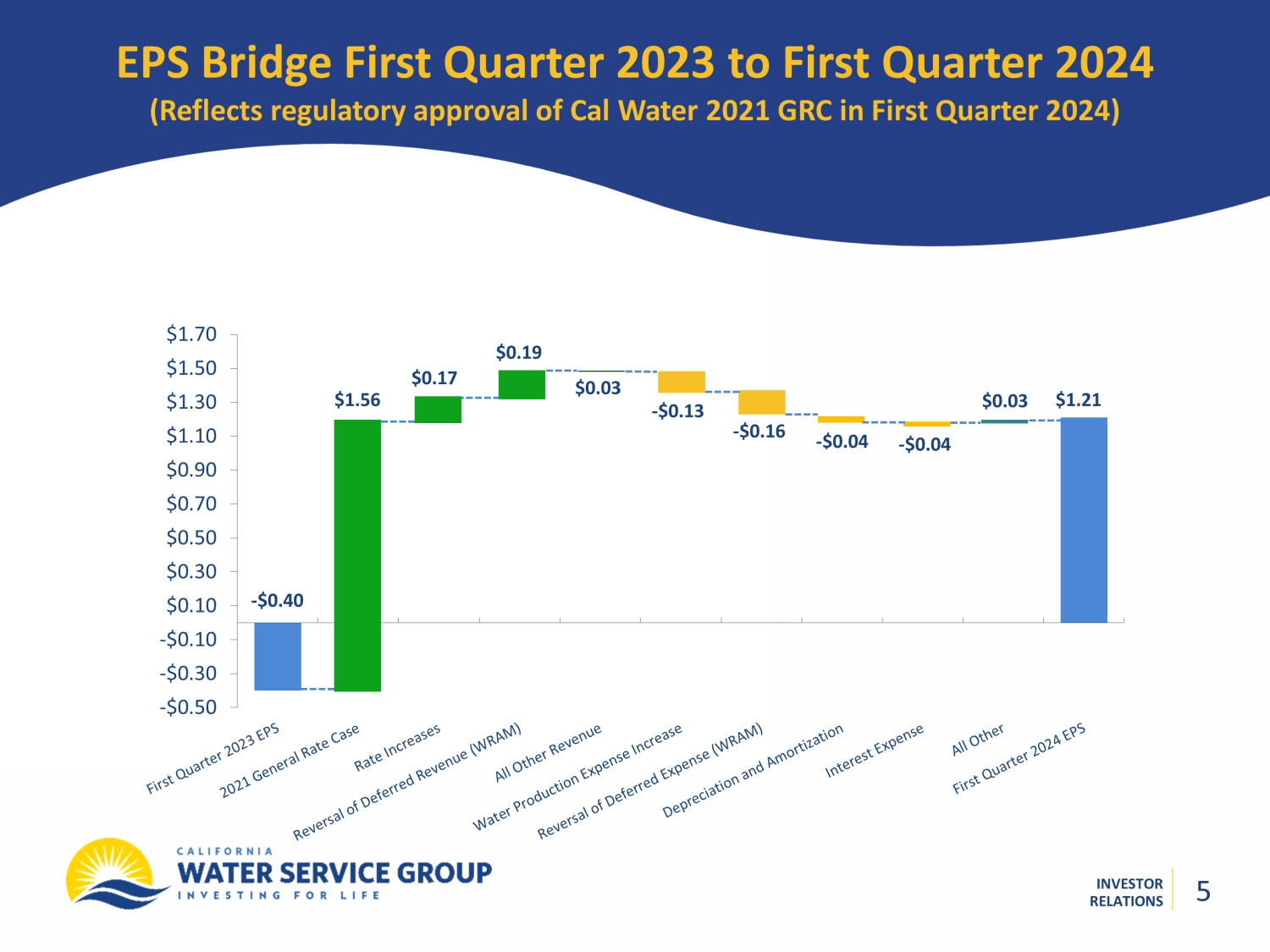

INVESTOR RELATIONS EPS Bridge First Quarter 2023 to First Quarter 2024 (Reflects regulatory approval of Cal Water 2021 GRC in First Quarter 2024) -$0.50 -$0.30 -$0.10 $0.10 $0.30 $0.50 $0.70 $0.90 $1.10 $1.30 $1.50 $1.70 - $0.04 - $0.04 - $0.40 - $0.13 $0. 03 $0.03 $0.17 $1.56 $0.1 9 - $0.1 6 $ 1.21 5

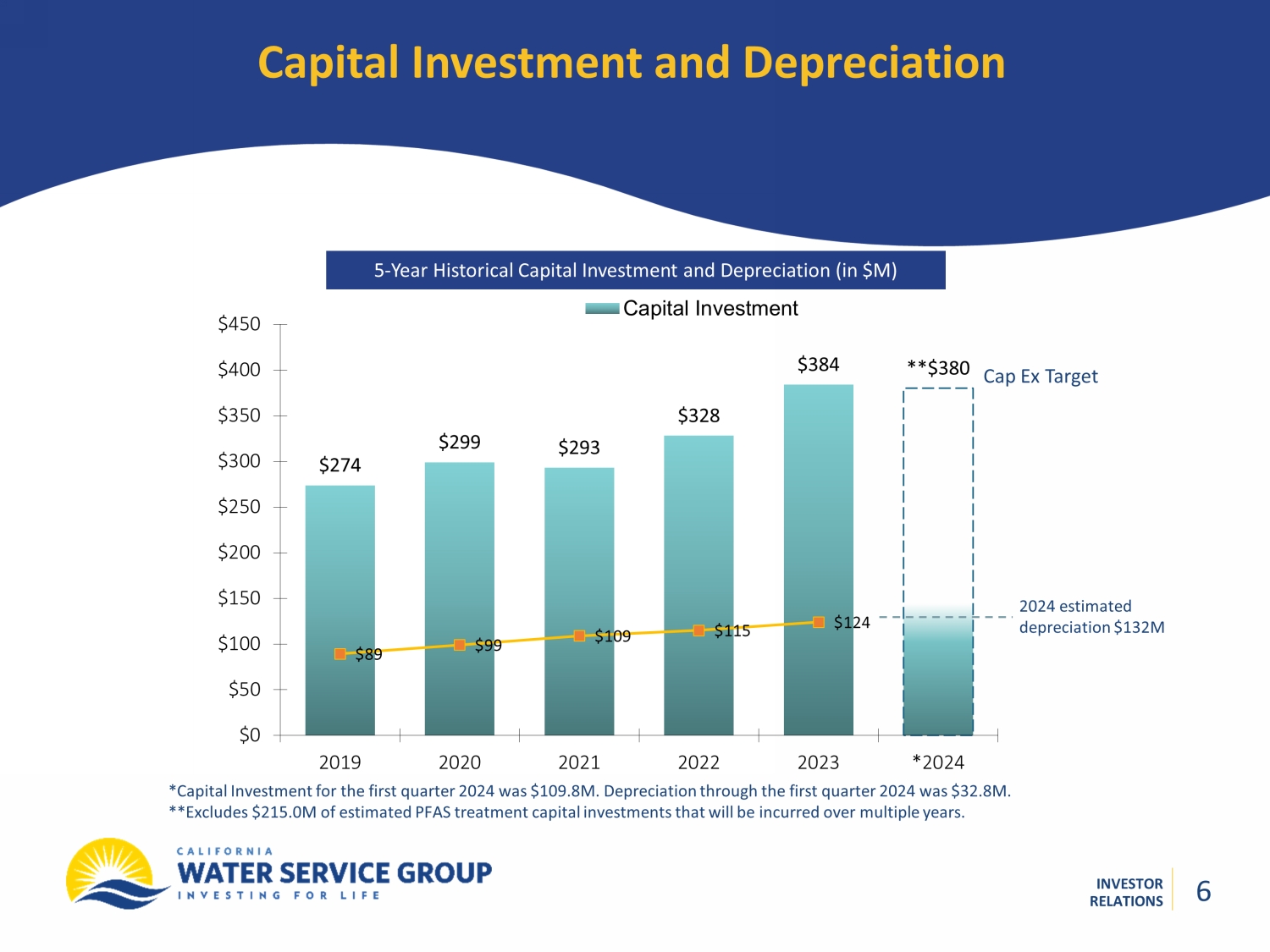

INVESTOR RELATIONS $274 $299 $293 $328 $384 **$380 $89 $99 $109 $115 $124 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2019 2020 2021 2022 2023 *2024 Capital Investment 5 - Year Historical Capital Investment and Depreciation (in $M) *Capital Investment for the first quarter 2024 was $109.8M. Depreciation through the first quarter 2024 was $32.8M. **Excludes $215.0M of estimated PFAS treatment capital investments that will be incurred over multiple years. Cap Ex Target 2024 estimated depreciation $132M Capital Investment and Depreciation 6

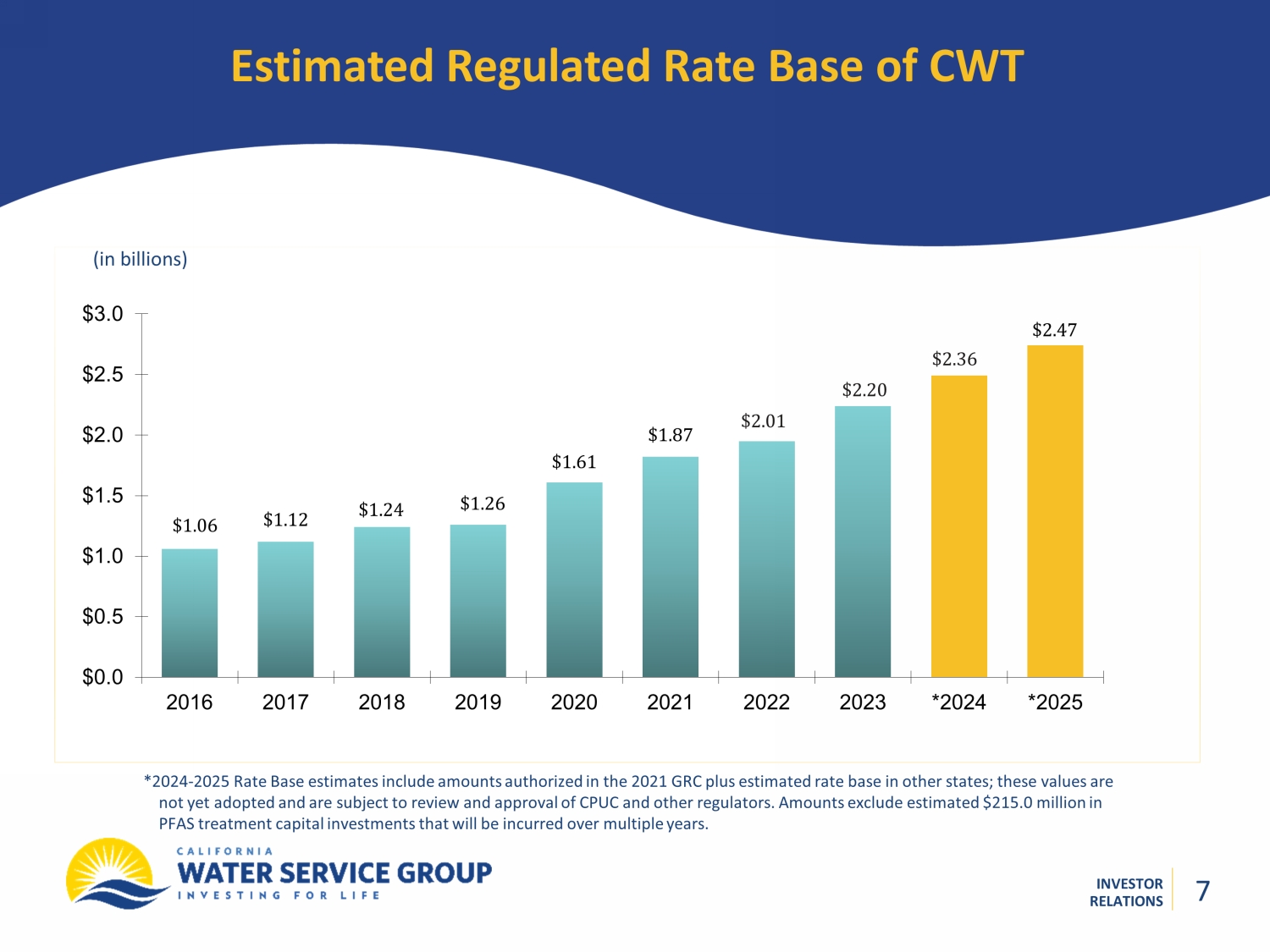

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions) *2024 - 2025 Rate Base estimates include amounts authorized in the 2021 GRC plus estimated rate base in other states; these values are not yet adopted and are subject to review and approval of CPUC and other regulators. Amounts exclude estimated $215.0 million in PFAS treatment capital investments that will be incurred over multiple years . $1.06 $1.12 $1.24 $1.61 $1.26 $1.87 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 2023 *2024 *2025 $2.47 7 7 $2.01 $2.20 $2.36

INVESTOR RELATIONS • Increased annual dividend 7.7% from $1.04 per share to $1.12 per share. This is the company’s 57 th consecutive dividend increase. • Declared 317 th consecutive quarterly dividend of $0.28 per share. • Secured $83.0 million in additional state funding through the California Extended Water and Wastewater Arrearages Payment Program to relieve eligible California customers of past - due balances accumulated during the COVID pandemic; program funds were received after the Q2 2024 quarter end. • Ended Q1 2024 with $88.3 million of cash, of which $45.4 million was classified as restricted, and additional short - term borrowing capacity of $320.0 million. Dividends | Cash Flow | Capital Allocation 8 Continue to maintain financial discipline with a strong balance sheet, while allocating capital in a manner consistent with our capital infrastructure improvement plan

INVESTOR RELATIONS • Final d ecision approved on March 7 , 2024 on the 2021 GRC . • Increases adopted revenues, after corrections, for 2023 by approximately $ 41 . 5 million, retroactive to January 1 , 2023 . Also potentially increases adopted revenues by up to approximately $ 30 . 0 million for 2024 and $ 30 . 6 million for 2025 , subject to the CPUC's earnings test and inflationary adjustments . • Authorizes Cal Water to invest approximately $ 1 . 2 billion from 2021 through 2024 in water system infrastructure projects that are needed to continue providing safe, reliable water service to customers throughout California, including approximately $ 160 million of infrastructure projects that may be submitted for recovery via the CPUC's advice letter process . From 2021 through 2023 , Cal Water capital investments totaled approximately $ 855 million . • Approves a progressive rate design that is intended to provide financial stability while benefiting low - income and low - water - using customers by decreasing the cost of the first six units of water consumed and increasing the percentage of fixed costs that are recovered in the service charge . 2021 GRC Resolution 9 Decision provides clarity for all stakeholders, while enabling CWT to continue to provide safe, reliable water service to customers throughout California

INVESTOR RELATIONS • $83 million will be applied to past - due balances accrued by residential and commercial customers between June 16, 2021, and December 31, 2022 during the COVID - 19 Pandemic. • Reflects our commitment to supporting all customers, particularly those who need assistance. • Funds will benefit both current and past - due customers. California Extended Water and Wastewater Arrearages Payment Program Proactively sought funding to assist our customers 10

INVESTOR RELATIONS • Cal Water, Hawaii Water Service (Hawaii Water), New Mexico Water Service (New Mexico Water), and Washington Water Service (Washington Water) have a rigorous, coordinated water quality assurance program and protocols in place to test and monitor the water they deliver to customers . • In California and Washington, Group’s utilities have been complying with previously issued PFAS guidelines issued by State regulators . • On April 18 , 2024 , the CPUC dismissed without prejudice Cal Water’s application requesting authorization to modify a previously approved PFAS - expense memorandum account to include capital investments related to PFAS compliance . The CPUC instructed Cal Water to include PFAS capital investments in a future GRC or separate application . • Despite the CPUC decision, the Company reaffirmed its commitment to investing an estimated $ 215 . 0 million in PFAS treatment across its operating utilities and to working quickly to complete planned projects . Investments in PFAS Treatment 11 Group believes it is well - positioned to meet the EPA’s new PFAS regulation

INVESTOR RELATIONS • Group has committed to reducing absolute Scope 1 and 2 GHG emissions by 63% by 2035 from a 2021 base year. • T arget is science - aligned. • Group expects to achieve these reductions through a multi - pronged approach that includes fleet electrification, water conservation, onsite solar installations, and renewable electricity procurement. • Group may evolve its decarbonization strategy if warranted by changes in the industry, business, and/or operating environment. • Group is committed to delivering value to customers and stockholders while pursuing reduction targets. Greenhouse Gas Scope 1 and 2 Reduction Targets Set 12 Group Continues to Make Progress on ESG

INVESTOR RELATIONS Q1 2024 Key Messages 13 Resolution of the 2021 California GRC Issuance of new EPA PFAS regulation $83 million in additional state funding to relieve California customers of past - due balances accumulated during the pandemic Commitment to reducing absolute Scope 1 and 2 GHG emissions by 63% by 2035 Focus turns to executing our infrastructure improvement plan and filing the 2024 California GRC

Q&A