EXHIBIT 99.2

Published on February 29, 2024

Exhibit 99.2

0 2023 Year and Fourth Quarter Earnings Results Presentation February 29, 2024

INVESTOR RELATIONS Forward - Looking Statements This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("PSL RA"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment established by th e PSLRA. Forward - looking statements in this news release are based on currently available information, expectations, estimates, assumptions and projections, and our managemen t’s beliefs, assumptions, judgments and expectations about us, the water utility industry and general economic conditions. These statements are not statements of his tor ical fact. When used in our documents, statements that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could , e stimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks or variations of these words or similar expressions are intended to identi fy forward - looking statements. Examples of forward - looking statements in this news release include , but are not limited to, statements describing Cal Water’s authorized return on equity, expectations regarding the 2021 GRC Fi lin g and the regulatory process , including timing and business and financial impacts, completion of pending acquisitions, estimated capital investments and de pre ciation and rate base estimates. Forward - looking statements are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks. Consequently, actual results may vary materially from what is conta ine d in a forward - looking statement. Factors that may cause actual results to be different than those expected or anticipated include, but are not limited to: our ability to i nve st or apply the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commissions' decisions, including decisions on proper disposition o f p roperty; consequences of eminent domain actions relating to our water systems; changes in regulatory commissions' policies and procedures , such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs, which impacted the 2021 GRC Filing; the outcome and timeliness of regulatory commissions' actions concerning rate relief and other matters, including with respect to the 2021 GRC Filing; increased risk of inverse condemnation losses as a result of climate change and drought; our abi lity to renew leases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water quality standards; chang es in environmental compliance and water quality requirements; electric power interruptions, especially as a result of Public Safety Power Shutoff (PSPS) programs; housing an d c ustomer growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with the implementation, maintenance or secur ity of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and thre ats ; the ability of our enterprise risk management processes to identify or address risks adequately; labor relations matters as we negotiate with the unions; changes in custom er water use patterns and the effects of conservation, including as a result of drought conditions; our ability to complete, in a timely manner or at all, successfull y i ntegrate and achieve anticipated benefits from announced acquisitions; the impact of weather, climate change, natural disasters, and actual or threatened public health emer gen cies, including disease outbreaks, on our operations, water quality, water availability, water sales and operating results and the adequacy of our emergency preparedne ss; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; risks associated with expanding our business and operations geographically; the impact of stagnating or worsening business and economic conditions, in cluding inflationary pressures, general economic slowdown or a recession, increasing interest rates, instability of certain financial institutions, changes in moneta ry policy, adverse capital markets activity or macroeconomic conditions as a result of the geopolitical conflicts, and the prospect of a shutdown of the U.S. federal govern men t; the impact of market conditions and volatility on unrealized gains or losses on our non - qualified benefit plan investments and our operating results; the impact of weather and timing of meter reads on our accrued unbilled revenue; the impact of evolving legal and regulatory requirements, including emerging environmental, social and governance re qui rements; and other risks and unforeseen events described in our SEC filings. In light of these risks, uncertainties and assumptions, investors are cautioned not to p lac e undue reliance on forward - looking statements, which speak only as of the date of this news release. When considering forward - looking statements, you should keep in mind the c autionary statements included in this paragraph, as well as the Annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchang e Commission (SEC). We are not under any obligation, and we expressly disclaim any obligation to update or alter any forward - looking statements, whether as a result of n ew information, future events or otherwise. 1

INVESTOR RELATIONS David Healey Principal Financial officer Marty Kropelnicki Chairman & CEO Today’s Participants 2 James Lynch Sr. Vice President, CFO & Treasurer Greg Milleman Vice President, Rates & Regulatory Affairs

INVESTOR RELATIONS Presentation Overview • Our Values and Priorities • 2023 Year Financial Results • 2023 Fourth Quarter Financial Results • California Regulatory Update • PFAS Regulation Update • Business Development Status • CapEx and Rate Base Tables • In Summary 3

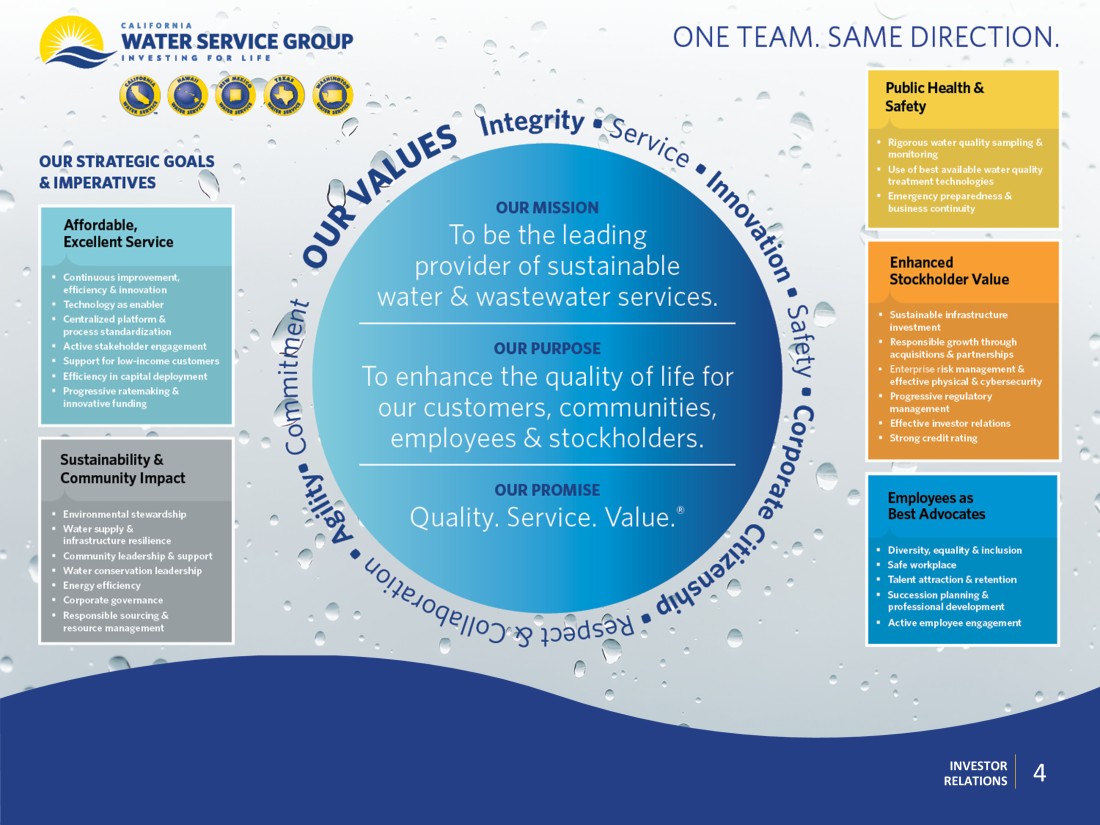

4 BOARD UPDATE BOARD UPDATE INVESTOR RELATIONS 4

INVESTOR RELATIONS The $44.1 million decrease in net income in 2023 compared to the prior year, was primarily due to the delayed final decision from the California Public Utilities Commission (“CPUC”) on California Water Service Company’s (“Cal Water”) pending 2021 General Rate Case (“2021 GRC”). In January 2024, the assigned CPUC Administrative Law Judges (“ALJs”) issued a Proposed Decision (“PD”) on the fully litigated 2021 GRC, and concurrently, the assigned CPUC Commissioner issued an Alternate Proposed Decision (“APD”) opposing and modifying certain decisions made by the ALJs. The PD issued by the ALJs was closer aligned to Cal Water’s requested revenue requirement where as the APD issued by the assigned CPUC Commissioner was closer aligned to the Public Advocates’ requested revenue requirement. We are unable to determine which of the two proposed decisions will be adopted by the CPUC, or if a second alternate proposed decision will be issued by the CPUC. As a result of uncertainty regarding the decision that will ultimately be made by the CPUC, we are unable to reasonably estimate the impact on 2023 operating revenue and expenses. Full Year 2023 Highlights ( Given the delay in regulatory approval of Cal Water’s 2021 GRC) 5

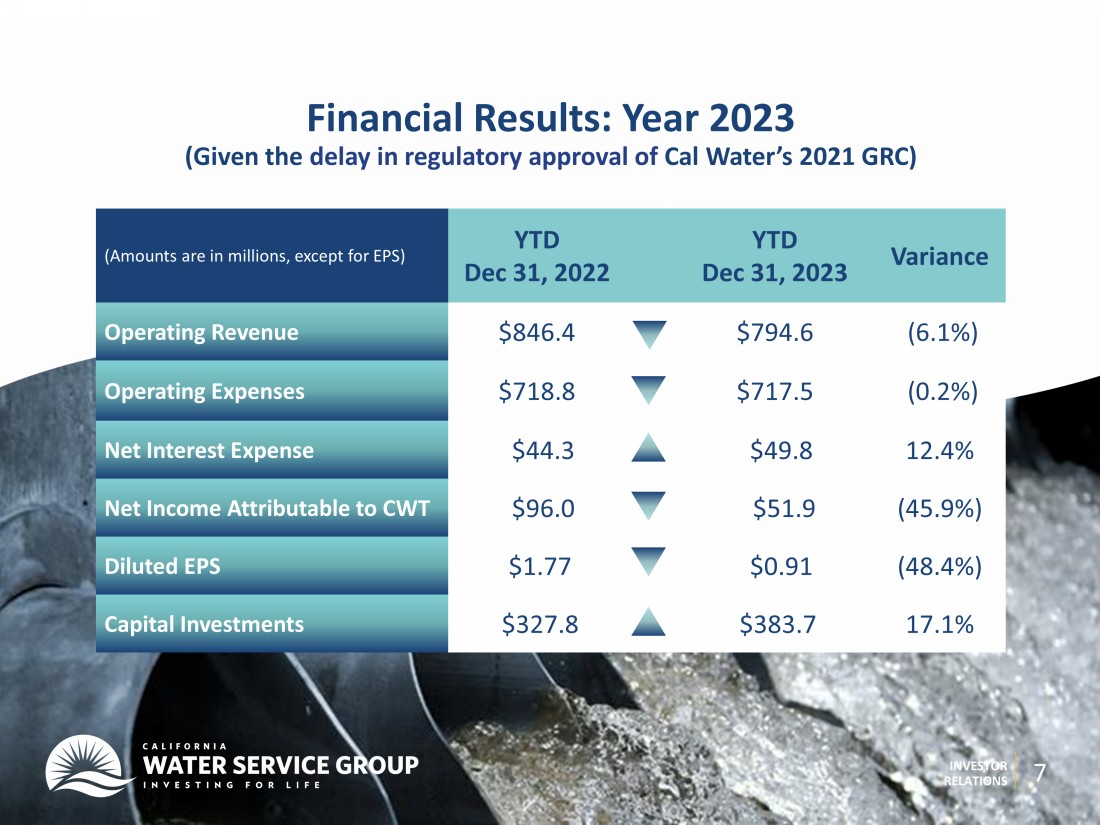

INVESTOR RELATIONS 2023 Year Financial Highlights (Given the delay in regulatory approval of Cal Water’s 2021 GRC) 6 Operating revenue decreased $51.8M • $66.9M decrease in WRAM and MCBA revenue as the mechanisms concluded on December 31, 2022. • $23.1M decrease in customer usage revenue. • $7.7M revenue decrease from an increase in deferred revenue. • Partially offset by $30.7M of rate increases, $6.7M revenue increase from new customers, and $3.5M increase from accrued unbilled revenue. Total operating expenses decreased $1.3M • $18.5M increase in income tax benefit. • $3.7M decrease in other operations expenses from an increase in deferred revenue. • Partially offset by $13.4M increase in labor costs, $3.2M increase in water production costs, and $6.6M increase in depreciation and amortization.

INVESTOR RELATIONS (Amounts are in millions, except for EPS) YTD Dec 31, 2022 YTD Dec 31, 2023 Variance Operating Revenue $846.4 $794.6 (6.1%) Operating Expenses $718.8 $717.5 (0.2%) Net Interest Expense $44.3 $49.8 12.4% Net In come Attributable to CWT $96.0 $51.9 (45.9%) Diluted EPS $1.77 $0.91 (48.4%) Capital Investments $327.8 $383.7 17.1% Financial Results: Year 2023 ( Given the delay in regulatory approval of Cal Water’s 2021 GRC) 7

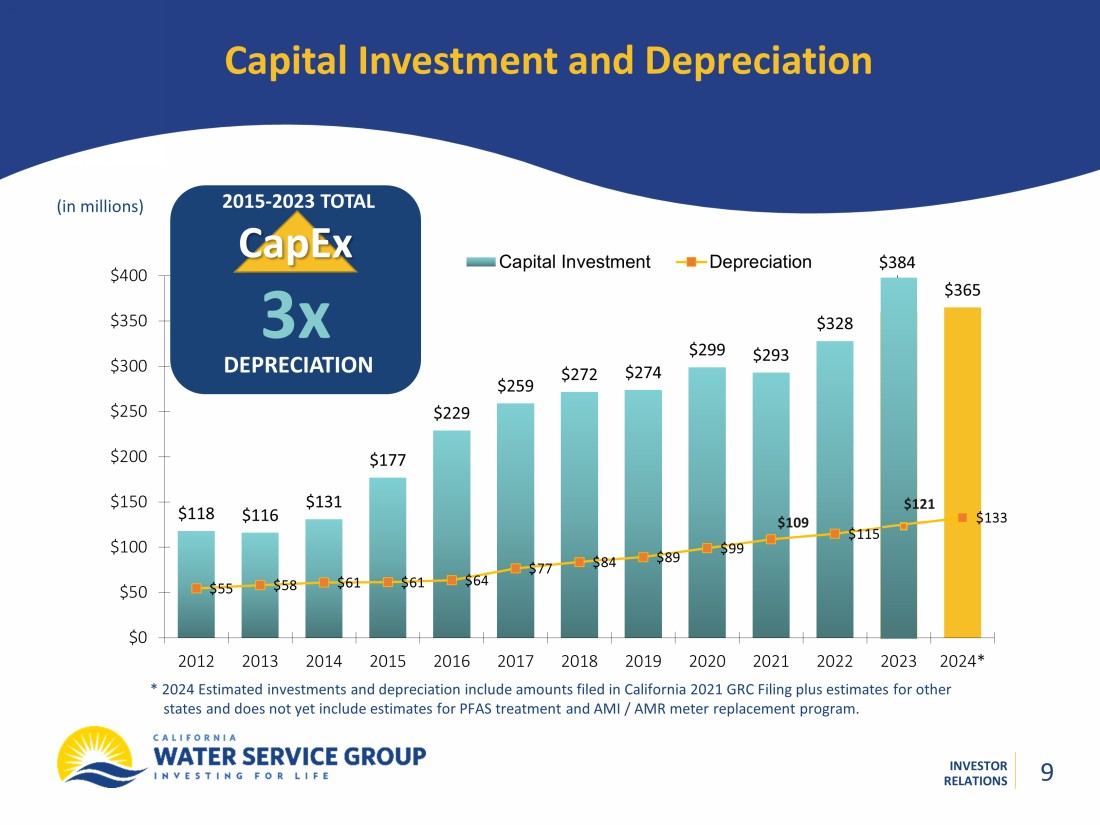

INVESTOR RELATIONS California Water Service Group (Group) Invested $383.7M in capital improvements in 2023, a 17.1% increase over 2022. The 2023 increase in income tax benefit of $18.5 million compared to the prior year, was primarily from a decrease in pre - tax operating income due to the delay in the regulatory approval of Cal Water’s 2021 GRC. 2023 increase in u nrealized gains on certain non - qualified benefit plan investments of $12.1 million compared to the prior year, was due to favorable changes in market conditions. Additional Full Year 2023 Highlights ( Given the delay in regulatory approval of Cal Water’s 2021 GRC) 8

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $293 $328 $384 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $115 $133 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024* Capital Investment Depreciation Capital Investment and Depreciation (in millions) * 2024 Estimated investments and depreciation include amounts filed in California 2021 GRC Filing plus estimates for other states and does not yet include estimates for PFAS treatment and AMI / AMR meter replacement program. 2015 - 2023 TOTAL CapEx 3x DEPRECIATION $109 9 $121 9

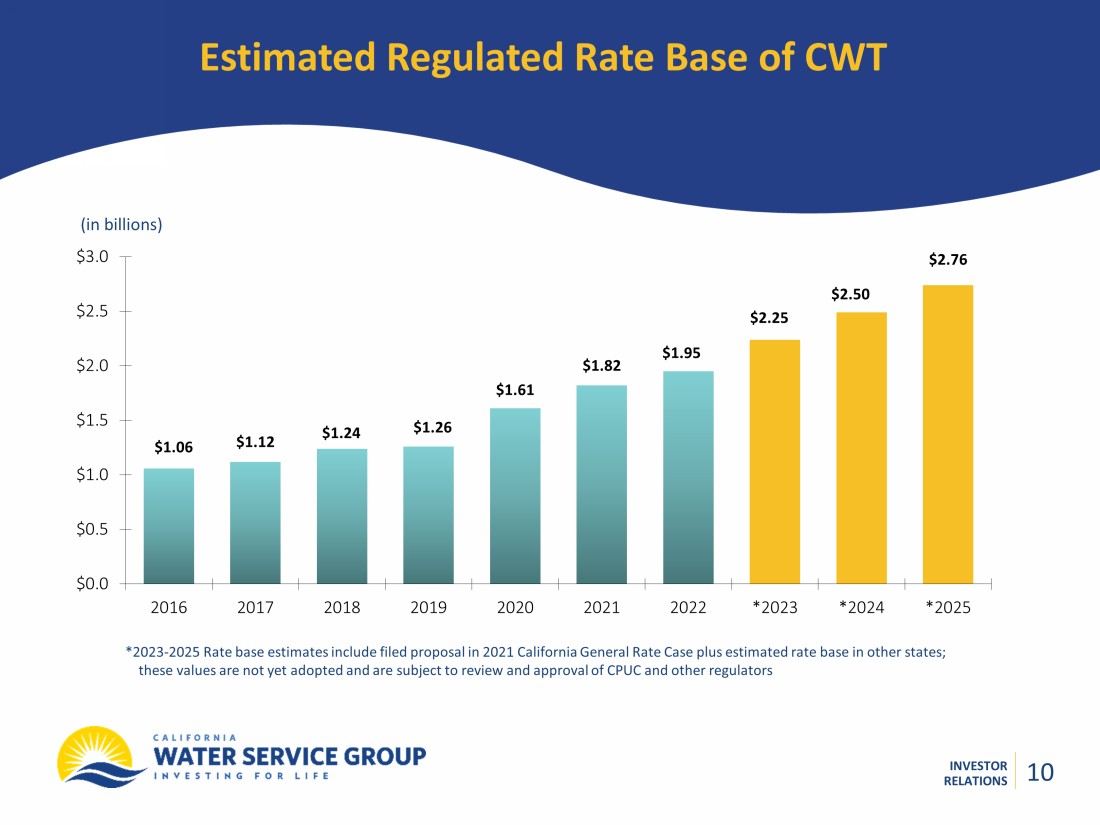

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions) *2023 - 2025 Rate base estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other sta tes; these values are not yet adopted and are subject to review and approval of CPUC and other regulators $1.06 $1.12 $1.24 $1.61 $2.76 $1.26 $1.82 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 *2023 *2024 *2025 $1.95 $2.25 $2.50 10 10

INVESTOR RELATIONS EPS Bridge Full Year 2022 to 2023 (Given the delay in regulatory approval of Cal Water’s 2021 GRC) $0.00 $0.50 $1.00 $1.50 $2.00 2022 EPS Decrease in WRAM and MCBA Revenue (Net) Rate Increases, Decrease in Consumption, New Customers (Net) A&G Expense, Other Operations Expense, Change in Deferred Revenue (Net) Water Production, Depreciation, Interest, Property Tax Expenses Net Other Income (Includes Unrealized Gains on Certain Non- qualified Benefit Plan Investments) Income Tax Benefit, Other (Net) 2023 EPS $0.21 - $1.10 $0.29 $ 1.77 - $0.27 - $0.23 $0.91 $0.24 1 1

INVESTOR RELATIONS 12 Fourth Quarter 2023 Financial Highlights (Given the delay in regulatory approval of Cal Water’s 2021 GRC) Operating revenue increased $13.6M • $13.8M revenue increase from rate increases. • $12.3M revenue increase from a decrease in deferred revenue. • $3.3M increase in customer usage revenue. • Partially offset a $18.1M decrease in WRAM and MCBA revenue as the mechanisms concluded on December 31, 2022. Total operating expenses increased $4.6M • $6.2M increase in water production costs. • $5.3M increase in labor costs. • $3.4M increase in depreciation and amortization. • Partially offset by an $11.2M increase in income tax benefit. 12

INVESTOR RELATIONS (Amounts are in millions, except for EPS) Fourth Quarter 2022 Fourth Quarter 2023 Variance Operating Revenue $200.9 $214.5 6.8% Operating Expenses $174.7 $179.3 2.6% Net Interest Expense $11.1 $12.3 11.2% Net In come Attributable to CWT $19.6 $30.1 53.8% Diluted EPS $0.35 $0.52 47.0% Capital Investments $105.7 $109.6 3.7% Financial Results: Fourth Quarter 2023 ( Given the delay in regulatory approval of Cal Water’s 2021 GRC) 13

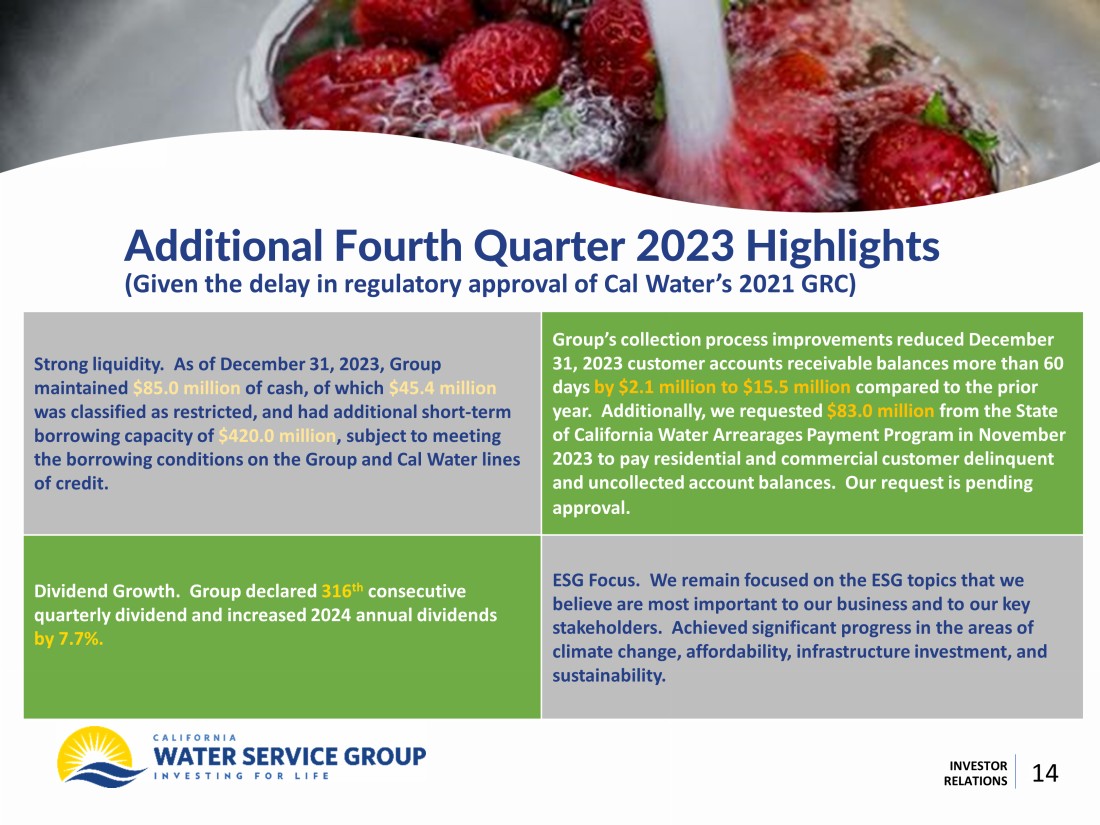

INVESTOR RELATIONS Additional Fourth Quarter 2023 Highlights (Given the delay in regulatory approval of Cal Water’s 2021 GRC) 14 14 Strong liquidity. As of December 31, 2023, Group maintained $85.0 million of cash, of which $45.4 million was classified as restricted, and had additional short - term borrowing capacity of $420.0 million , subject to meeting the borrowing conditions on the Group and Cal Water lines of credit. Group’s collection process improvements reduced December 31, 2023 customer accounts receivable balances more than 60 days by $2.1 million to $15.5 million compared to the prior year. Additionally, we requested $83.0 million from the State of California Water Arrearages Payment Program in November 2023 to pay residential and commercial customer delinquent and uncollected account balances. Our request is pending approval. Dividend Growth. Group declared 316 th consecutive quarterly dividend and increased 2024 annual dividends by 7.7%. ESG Focus. We remain f ocused on the ESG topics that we believe are most important to our business and to our key stakeholders. Achieved significant progress in the areas of climate change, affordability, infrastructure investment, and sustainability.

INVESTOR RELATIONS EPS Bridge Fourth Quarter 2022 to 2023 (Given the delay in regulatory approval of Cal Water’s 2021 GRC) $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 Fourth Quarter 2022 EPS Decrease in WRAM and MCBA Revenue (Net) Rate Increases, Increase in Customer Usage, New Customers A&G Expense, Other Operations Expense, Change in Deferred Revenue (Net) Water Production, Depreciation, Interest, Property Tax Expenses Net Other Income Income Tax Benefit, Other (Net) Fourth Quarter 2023 EPS $0.05 - $0.30 $0.20 $0.35 - $0.16 $0. 08 $0.52 $0. 30 15

INVESTOR RELATIONS California 2021 General Rate Case Update On January 24, 2024, the assigned CPUC ALJs issued a PD on the fully litigated 2021 GRC, and concurrently, the assigned CPUC Commissioner issued an APD opposing and modifying certain decisions made by the ALJs. On February 13, 2024, Cal Water completed a CPUC filing. In our filing, Cal Water stated support for the ALJs PD, recommended significant changes to the APD, and requested changes to several elements in the PD and APD including correction of possible technical issues. The earliest the CPUC can deliberate on the PD and APD is March 7, 2023. On February 20, 2024, Cal Water completed a CPUC filing to explain Cal Water’s disagreements with certain comments by the Public Advocates on the PD in their February 13, 2024 CPUC filing. 16

INVESTOR RELATIONS California 2021 General Rate Case Update, Continued 17 On February 13, 2024, California Water Association, a party to the 2021 GRC, completed a filing with the CPUC expressing concerns that the APD departs from standard CPUC practice and precedent on capital projects and early retirements of capital investments. At the CPUC meeting on February 15, 2024 , during the open comment period, a pproximately twenty Cal Water customers, concerned citizens and businesses requested the CPUC to approve the PD and reject the APD. No speakers supported the APD. On February 16, 2024, several California utilities sent a letter to the CPUC expressing concern that the APD departs from standard CPUC practice and precedent.

INVESTOR RELATIONS California 2021 General Rate Case Update, Continued 18 We are unable to determine which of the proposed decisions will be adopted by the CPUC, or if a second alternate proposed decision will be issued by the CPUC. O nce approved by the CPUC, the Cal Water 2021 GRC cumulative adjustment plus interest, which is retroactive to January 1, 2023 , will be recorded.

INVESTOR RELATIONS California 2021 General Rate Case Update Focus on Decoupling Cal Water’s 2021 GRC contains provisions designed to mitigate the absence of a decoupling program: • Lower estimated sales, factoring in continued conservation efforts. • Rates designed to reduce revenue volatility but still send price signal to highest users. • Estimated production costs accounting for realistic mix of water sources. Cal Water and others have appealed CPUC decoupling decision to California Supreme Court; case expected to be heard within the first six months of 2024. In 2022, a Cal Water led coalition secured passage of legislation requiring CPUC to consider decoupling proposals, reversing a portion of CPUC's 2020 decision that prohibited utilities from even applying for decoupling. Cal Water will request decoup ling to be reinstated on January 1, 2026 in its July 1, 2024 GRC. 19

INVESTOR RELATIONS Cal Water’s Cost of Capital Proceeding Update CPUC granted Cal Water’s request to postpone the May 1, 2024 Water Cost of Capital proceeding to May 1, 2025. As a result of the 2023 adjustment from the Water Cost of Capital Mechanism (WCCM), Cal Water’s authorized return on equity (ROE) is 10.27% in 2024. In 2025, the ROE of 10.27% may be adjusted plus or minus any changes from the WCCM during the period from October 1, 2023 to September 30, 2024. WCCM adjusts Cal Water’s return on equity rate up or down when the Moody’s Utilities Bond Index fluctuates more than 100 basis points between Cost of Capital proceedings during the 12 - month period from October 1 to September 30. When the CPUC adopts Cal Water’s May 1, 2025 Cost of Capital proceeding decision, the new authorized capital structure, ROE and cost of debt rates, are expected to be effective on January 1, 2026. 20

INVESTOR RELATIONS PFAS Regulation Update • In March 2023, USEPA published draft Maximum Contaminant Levels (MCLs) for PFAS compounds. • Based on current information, if regulation is adopted in the current proposed form, we estimate capital investments of approximately $215M needed to comply. These capital investments will be incremental to the capital investments included in our GRC filings. o Draft regulation, if unchanged and finalized by 2024, would require compliance by 2027. While our regulators have a strong track record of allowing recovery for regulatorily required water treatment investments, there are also other potential sources of funds that could offset some or all investment over time. Cal Water filed an application to include infrastructure investments as well as operating expenses in existing memorandum account. 21

INVESTOR RELATIONS Business Development Project Updates 2023 Acquisitions System Water Connections Wastewater Connections Total Status Bethel Green Acres (WA) 200 200 Closed March 2023 Stroh’s Water (WA) 900 900 Closed July 2023 Skylonda (CA) 176 176 Closed August 2023 HOH Utilities (HI) 1,800 EDUs 1,800 EDUs Closed December 2023 Monterey Water (NM) 380 380 Closed December 2023 Camino Real Utility Water Pipeline (TX) Up to 5,000 for current phase Up to 5,000 for current phase Up to 10,000 for current phase Closed December 2023, pipeline facilities under construction KSSCS (HI) 400 EDUs 400 EDUs Announced April 2022* Number of Connections Added in 2023 3,856 active connections (10,000 greenfield connections) * Announced acquisitions below are subject to customary closing conditions and regulatory approval 22

INVESTOR RELATIONS In Summary 23 2023 Full Year and Fourth Quarter earnings results were in line with expectations given the delayed proposed decision on Cal Water’s 2021 GRC, which had an adverse impact on earnings results. The issuance of a PD and APD on January 24, 2024 is expected to result in a final decision during the first half of 2024. We remain laser focused on executing our strategy and serving our customers.

DISCUSSION