EXHIBIT 99.2

Published on July 28, 2022

Exhibit 99.2

0 Second Quarter 2022 Results Presentation July 28, 2022

INVESTOR RELATIONS Forward - Looking Statements This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("Act"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment e stablished by the Act. Forward - looking statements are based on currently available information, expectations, estimates, assumptions and projections, and ma nag ement's judgment about the Company, the water utility industry and general economic conditions. Such words as will, would, expects, intends, plans, beli eve s, may, estimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts or variations of such words or similar expressions are i nte nded to identify forward - looking statements. Forward - looking statements are not guarantees of future performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from what is contained in a forward - looking statement. Factors that may cause a result different than expect ed or anticipated include, but are not limited to: the impact of the ongoing COVID - 19 pandemic and related public health measures; our ability to invest or app ly the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commissions' decisions, including decisions on p rop er disposition of property; consequences of eminent domain actions relating to our water systems; changes in regulatory commissions' policies and procedu res , such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs in their next GRC filing (which impacted our 2021 GRC fili ng related to our operations commencing in 2023); the outcome and timeliness of regulatory commissions' actions concerning rate relief and other matters, inc luding with respect to our 2021 GRC filing; increased risk of inverse condemnation losses as a result of climate change and drought; our ability to rene w l eases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water quality standards; chang es in environmental compliance and water quality requirements; electric power interruptions, especially as a result of Public Safety Power Shutoff (PSPS) pr ogr ams; housing and customer growth; the impact of opposition to rate increases; our ability to recover costs; the impact of stagnating or worsening busin ess and economic conditions, including inflationary pressures, general economic slowdown or a recession, increasing interest rates, and changes in monetar y policy; availability of water supplies; issues with the implementation, maintenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and threats; the ability of our enterprise risk managem ent processes to identify or address risks adequately; labor relations matters as we negotiate with the unions; changes in customer water use patterns and the eff ect s of conservation; our ability to complete, in a timely manner or at all, successfully integrate and achieve anticipated benefits from announced acquisitions; the impact of weather, climate change, natural disasters, and actual or threatened public health emergencies, including disease outbreaks, on our operations , w ater quality, water availability, water sales and operating results and the adequacy of our emergency preparedness; restrictive covenants in or changes to the cre dit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; ris ks associated with expanding our business and operations geographically; and other risks and unforeseen events described in our SEC filings. When considering for ward - looking statements, you should keep in mind the cautionary statements included in this paragraph, as well as the Annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchange Commission (SEC). The Company assumes no obligation to provide public updates of forward - lookin g statements. 1

INVESTOR RELATIONS Today’s Participants Marty Kropelnicki President & CEO Tom Smegal Vice President, CFO & Treasurer Dave Healey Vice President, Controller 2

INVESTOR RELATIONS Presentation Overview o Our Values and Priorities o Financial Results o Financial Highlights and Earnings Bridges o California Regulatory Update o California Drought Update o Items to Watch in Second Half of 2022 o Business Development Status o CapEx and Rate Base Tables o In Summary 3

4 BOARD UPDATE 4 BOARD UPDATE INVESTOR RELATIONS 4

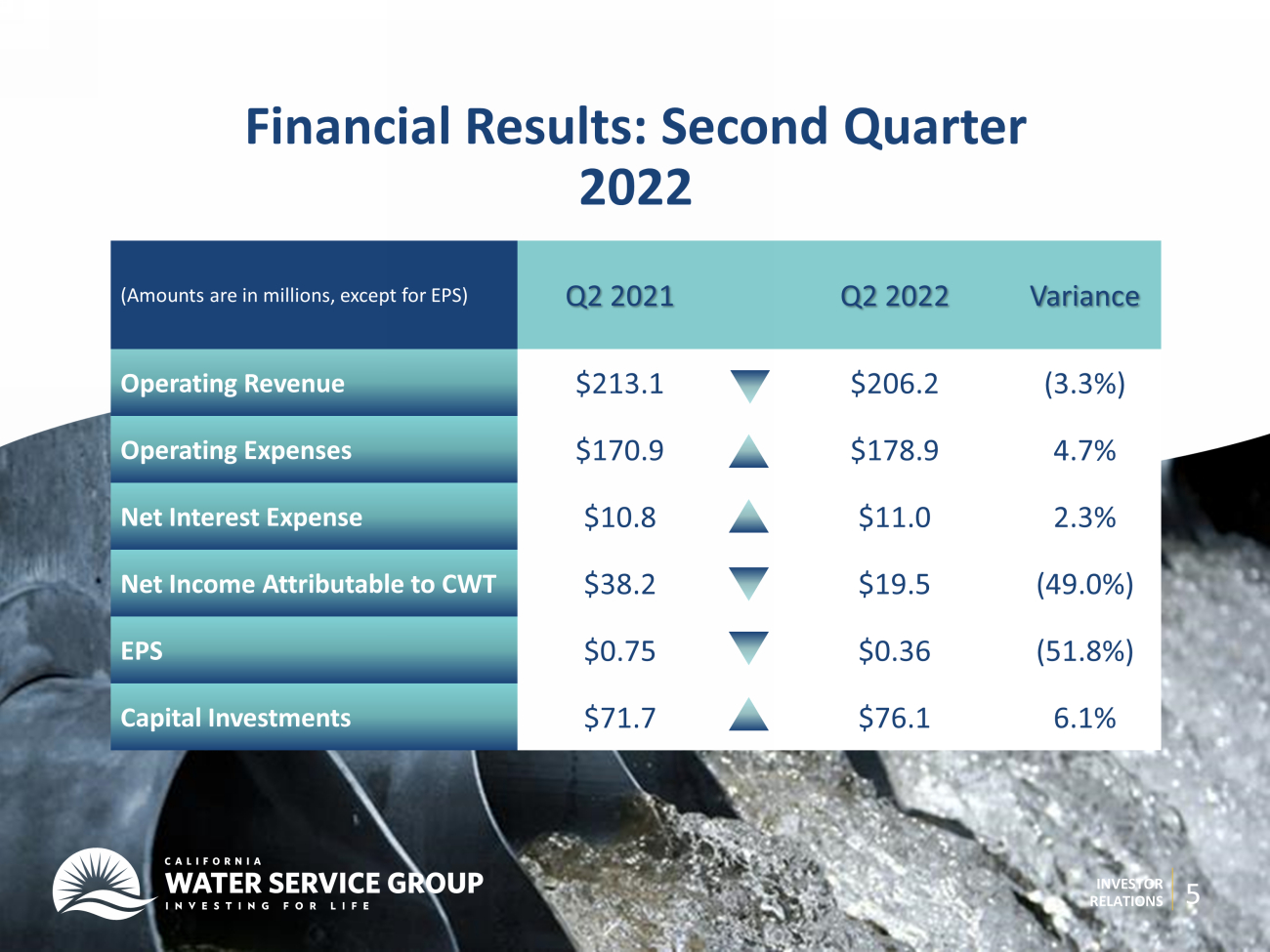

INVESTOR RELATIONS (Amounts are in millions, except for EPS) Q2 2021 Q2 2022 Variance Operating Revenue $213.1 $206.2 (3.3%) Operating Expenses $170.9 $178.9 4.7% Net Interest Expense $10.8 $11.0 2.3% Net In come Attributable to CWT $38.2 $19.5 (49.0%) EPS $0.75 $0.36 (51.8%) Capital Investments $71.7 $76.1 6.1% Financial Results: Second Quarter 2022 5

INVESTOR RELATIONS Financial Results: YTD 2022 (Amounts are in millions, except for EPS) YTD 2021 YTD 2022 Variance Operating Revenue $360.9 $379.2 5.1% Operating Expenses $315.7 $342.8 8.6% Net Interest Expense $20.7 $21.9 6.0% Net In come attributable to CWT $35.2 $20.6 (41.6%) EPS $0.69 $0.38 (45.0%) Capital Investments $138.5 $144.6 4.4% 6

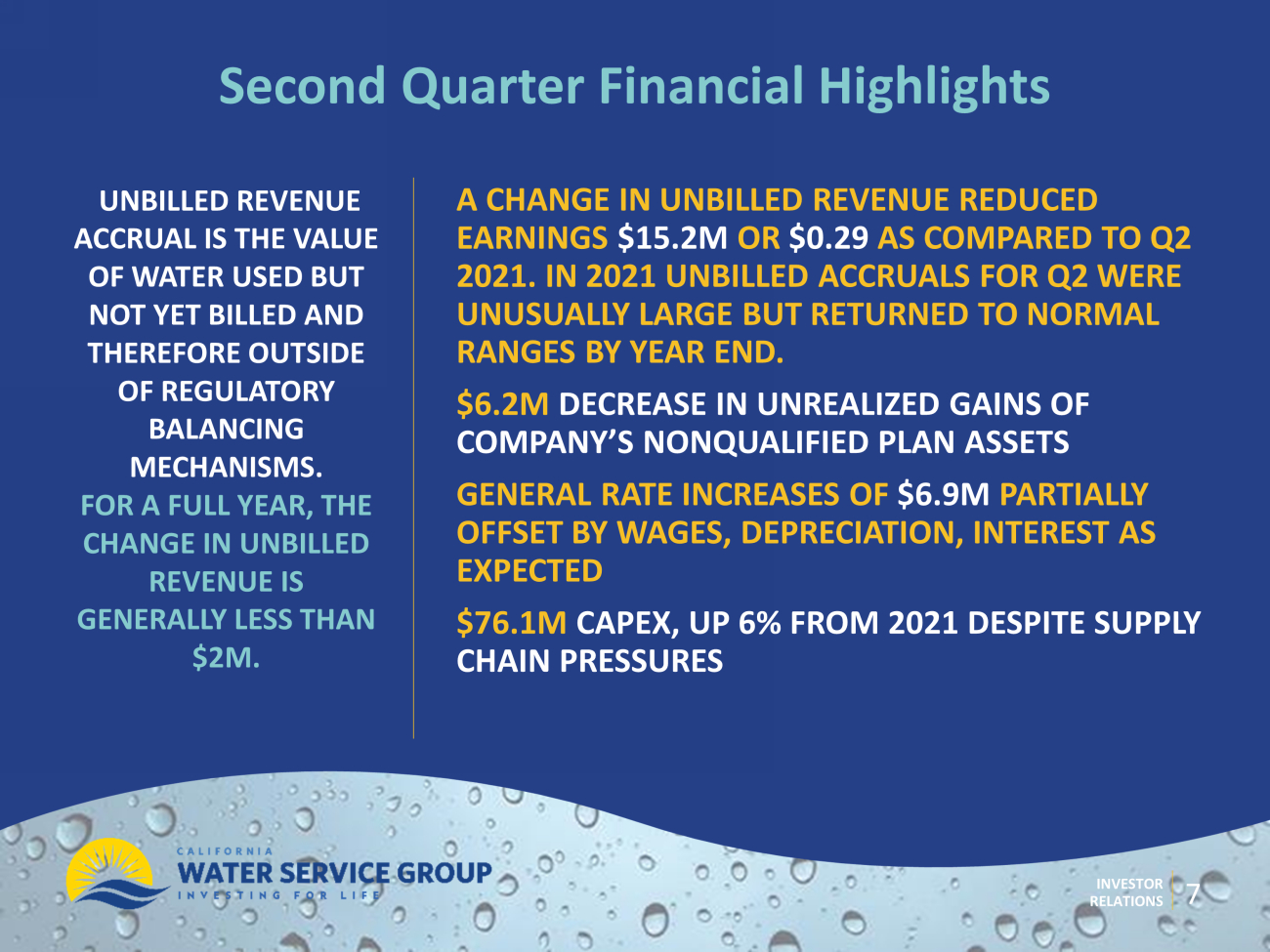

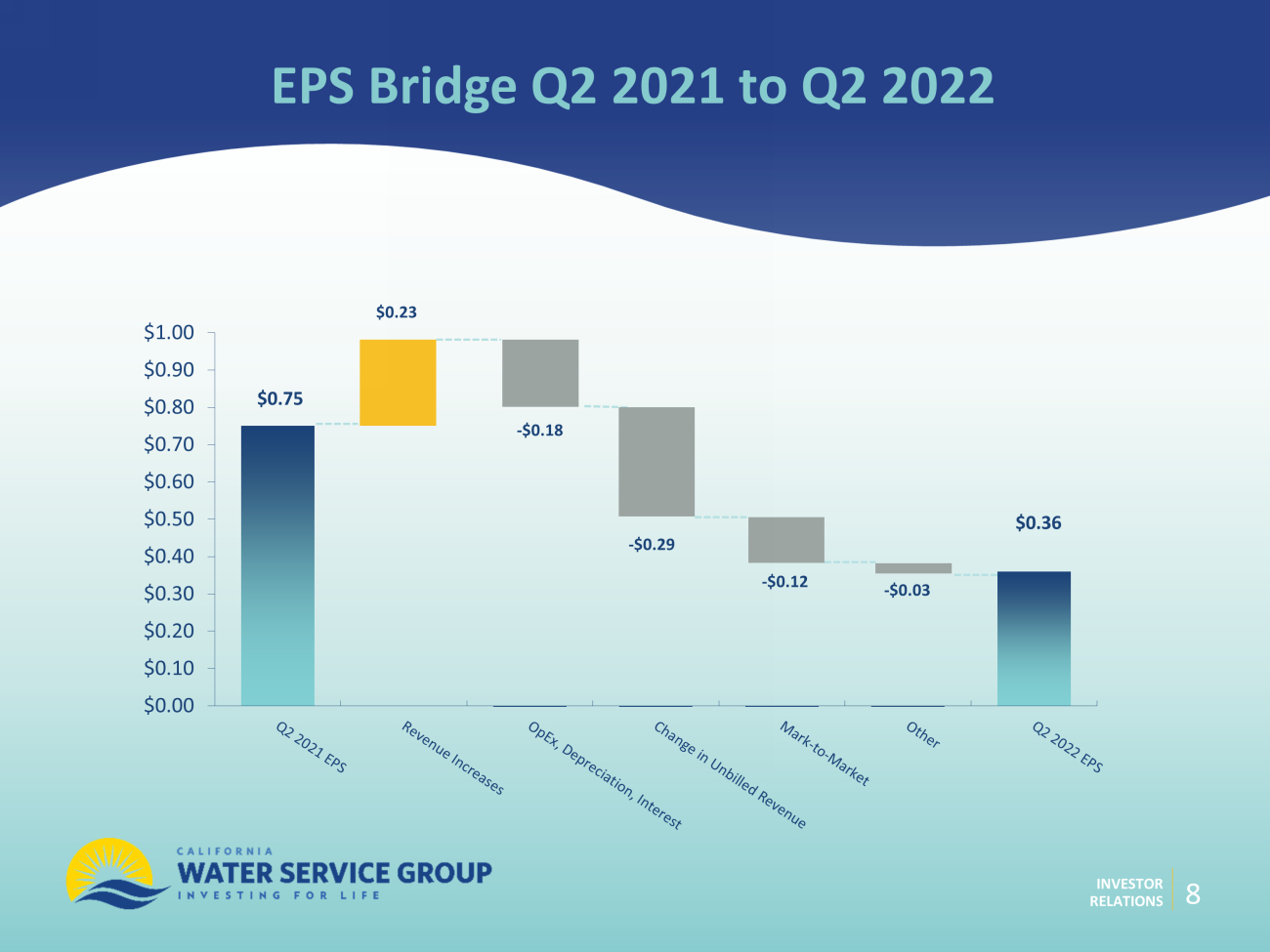

INVESTOR RELATIONS A CHANGE IN UNBILLED REVENUE REDUCED EARNINGS $15.2M OR $0.29 AS COMPARED TO Q2 2021. IN 2021 UNBILLED ACCRUALS FOR Q2 WERE UNUSUALLY LARGE BUT RETURNED TO NORMAL RANGES BY YEAR END. $6.2M DECREASE IN UNREALIZED GAINS OF COMPANY’S NONQUALIFIED PLAN ASSETS GENERAL RATE INCREASES OF $6.9M PARTIALLY OFFSET BY WAGES, DEPRECIATION, INTEREST AS EXPECTED $76.1M CAPEX, UP 6% FROM 2021 DESPITE SUPPLY CHAIN PRESSURES Second Quarter Financial Highlights UNBILLED REVENUE ACCRUAL IS THE VALUE OF WATER USED BUT NOT YET BILLED AND THEREFORE OUTSIDE OF REGULATORY BALANCING MECHANISMS. FOR A FULL YEAR, THE CHANGE IN UNBILLED REVENUE IS GENERALLY LESS THAN $2M. 7

INVESTOR RELATIONS EPS Bridge Q2 2021 to Q2 2022 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 - $0.03 - $0.29 $0.75 - $0.18 $0.23 $0.36 - $0.12 8

INVESTOR RELATIONS EPS Bridge YTD 2021 to YTD 2022 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 - $0.04 - $0.23 $0.69 - $0.35 $0.48 $0.38 - $0.17 9

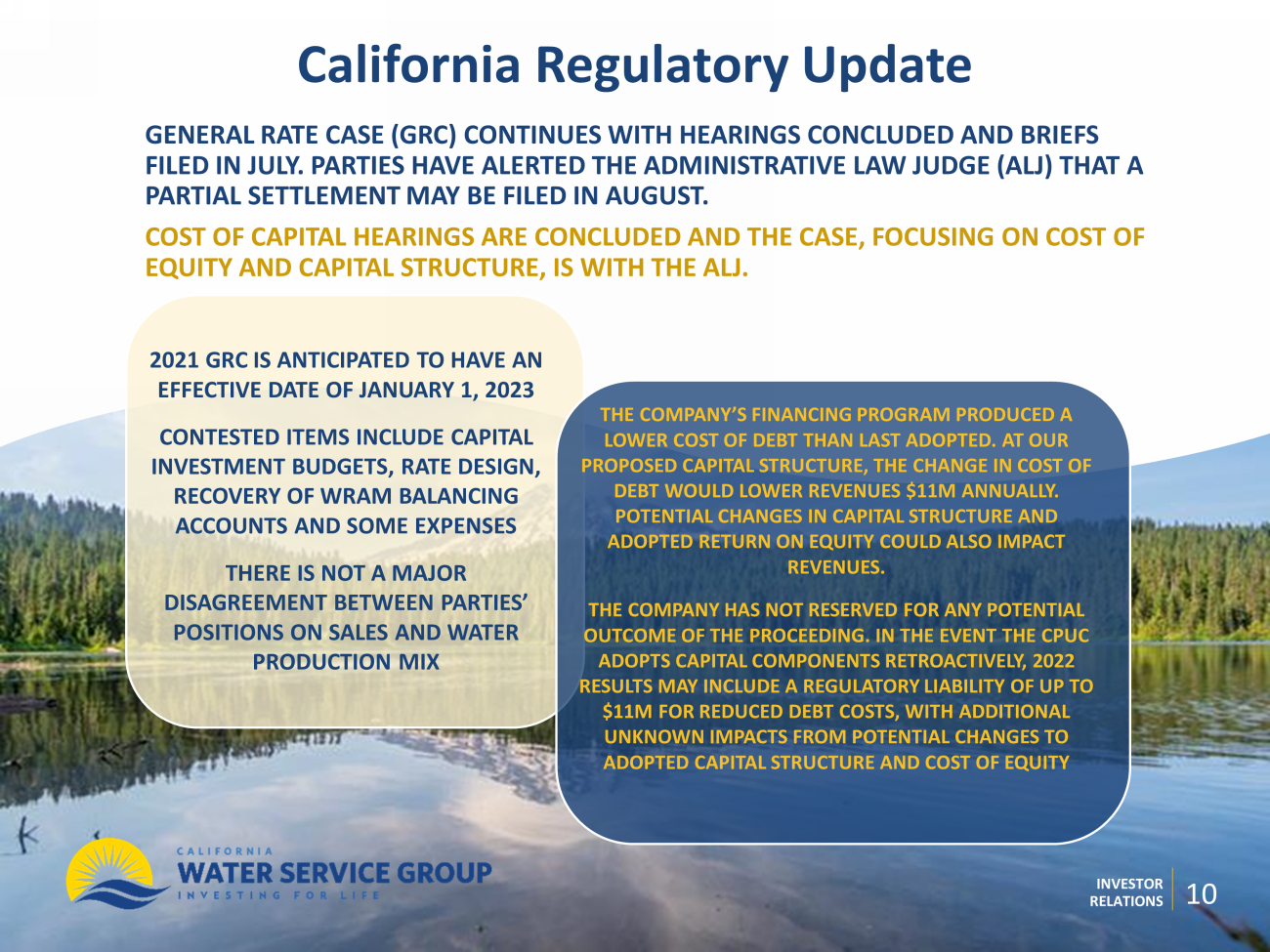

INVESTOR RELATIONS California Regulatory Update GENERAL RATE CASE (GRC) CONTINUES WITH HEARINGS CONCLUDED AND BRIEFS FILED IN JULY . PARTIES HAVE ALERTED THE ADMINISTRATIVE LAW JUDGE (ALJ) THAT A PARTIAL SETTLEMENT MAY BE FILED IN AUGUST. COST OF CAPITAL HEARINGS ARE CONCLUDED AND THE CASE, FOCUSING ON COST OF EQUITY AND CAPITAL STRUCTURE, IS WITH THE ALJ. THE COMPANY’S FINANCING PROGRAM PRODUCED A LOWER COST OF DEBT THAN LAST ADOPTED. AT OUR PROPOSED CAPITAL STRUCTURE, THE CHANGE IN COST OF DEBT WOULD LOWER REVENUES $11M ANNUALLY. POTENTIAL CHANGES IN CAPITAL STRUCTURE AND ADOPTED RETURN ON EQUITY COULD ALSO IMPACT REVENUES. THE COMPANY HAS NOT RESERVED FOR ANY POTENTIAL OUTCOME OF THE PROCEEDING. IN THE EVENT THE CPUC ADOPTS CAPITAL COMPONENTS RETROACTIVELY, 2022 RESULTS MAY INCLUDE A REGULATORY LIABILITY OF UP TO $11M FOR REDUCED DEBT COSTS, WITH ADDITIONAL UNKNOWN IMPACTS FROM POTENTIAL CHANGES TO ADOPTED CAPITAL STRUCTURE AND COST OF EQUITY 2021 G RC IS ANTICIPATED TO HAVE AN EFFECTIVE DATE OF JANUARY 1, 2023 CONTESTED ITEMS INCLUDE CAPITAL INVESTMENT BUDGETS, RATE DESIGN, RECOVERY OF WRAM BALANCING ACCOUNTS AND SOME EXPENSES THERE IS NOT A MAJOR DISAGREEMENT BETWEEN PARTIES’ POSITIONS ON SALES AND WATER PRODUCTION MIX 10

INVESTOR RELATIONS CALIFORNIA DROUGHT CONTINUES, PRIMARILY IMPACTING SURFACE WATER AVAILABILITY CALIFORNIA STATE WATER PROJECT DELIVERIES ARE AT 5% , IMPACTING SOME REGIONS SOLELY RELIANT ON IT CALIFORNIA CUSTOMER USAGE DOWN 5% IN Q2 AS COMPARED TO 2021 DROUGHT CONTINUES TO HIGHLIGHT NEED FOR WATER SUPPLY RESILIENCY IN THE FACE OF CLIMATE CHANGE ALL CALIFORNIA DISTRICTS IN “STAGE 2” DROUGHT RESTRICTIONS CAL WATER’S Q2 DROUGHT EXPENDITURES OF $0.4M ARE RECORDED IN A MEMORANDUM ACCOUNT FOR POTENTIAL FUTURE RECOVERY. TOTAL BALANCE SINCE 2021 IS $1.2M. California Drought Update 11

INVESTOR RELATIONS Other Issues to Watch in the Second H alf of 2022 Capital Spending Bad Debt Expense Capital spending for Q2 remains on track, but risks continue to be elevated • Supply chains, inflation, availability of contractors may contribute to slower spending rate • Uncertainty of regulatory approval in California Reserve for bad debt remains elevated at $6.7M o California regulatory process has recently begun allowing shutoffs for nonpayment o Customer response will be critical o Other state operations have seen reductions in bad debt once collection activity restarted 12

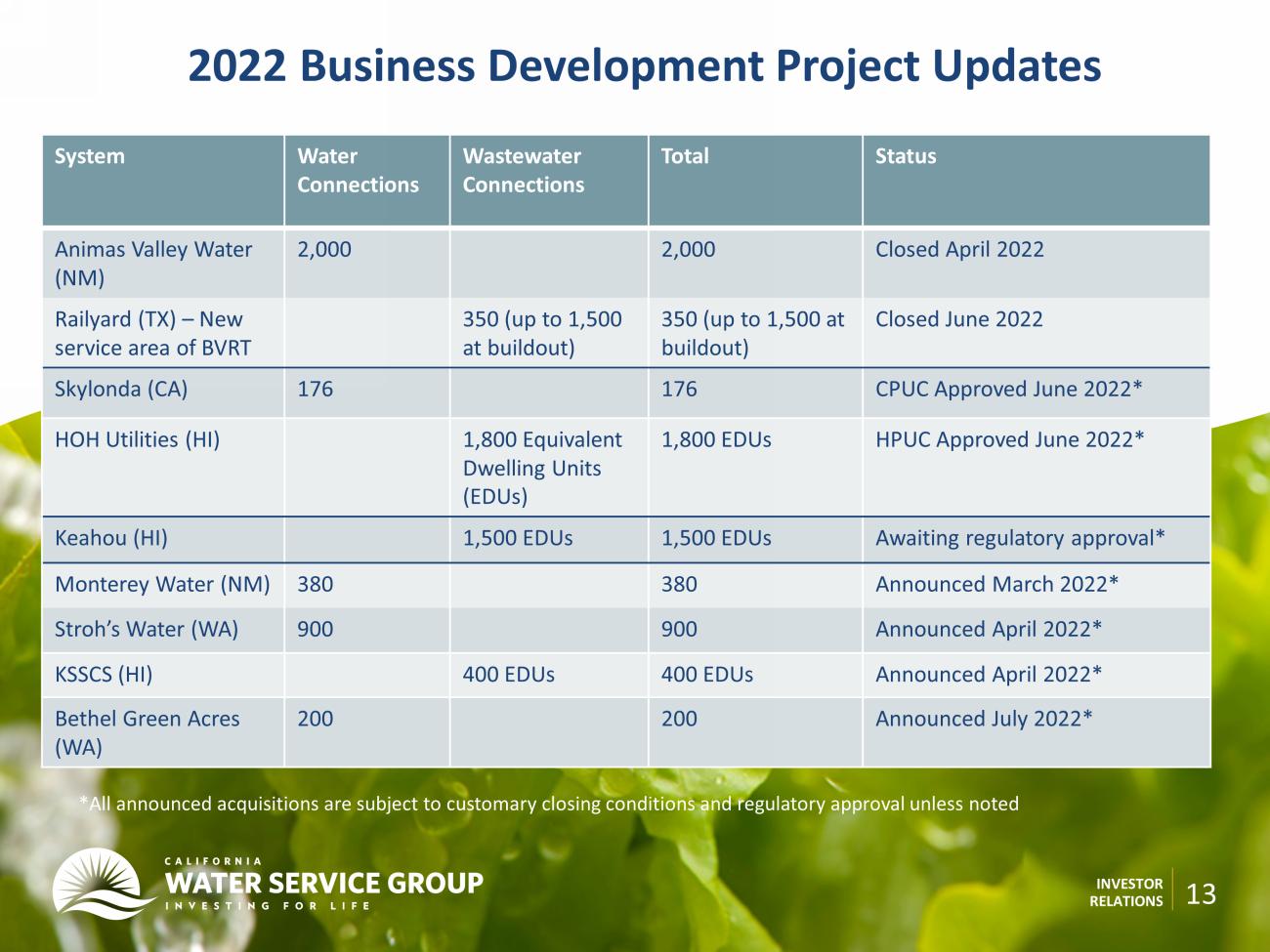

INVESTOR RELATIONS 2022 Business Development Project Updates System Water Connections Wastewater Connections Total Status Animas Valley Water (NM) 2,000 2,000 Closed April 2022 Railyard (TX) – New service area of BVRT 350 (up to 1,500 at buildout) 350 (up to 1,500 at buildout) Closed June 2022 Skylonda (CA) 176 176 CPUC Approved June 2022* HOH Utilities (HI) 1,800 Equivalent Dwelling Units (EDUs) 1,800 EDUs HPUC Approved June 2022 * Keahou (HI) 1,500 EDUs 1,500 EDUs Awaiting regulatory approval * Monterey Water (NM) 380 380 Announced March 2022* Stroh’s Water (WA) 900 900 Announced April 2022* KSSCS (HI) 400 EDUs 400 EDUs Announced April 2022* Bethel Green Acres (WA) 200 200 Announced July 2022* *All announced acquisitions are subject to customary closing conditions and regulatory approval unless noted 13

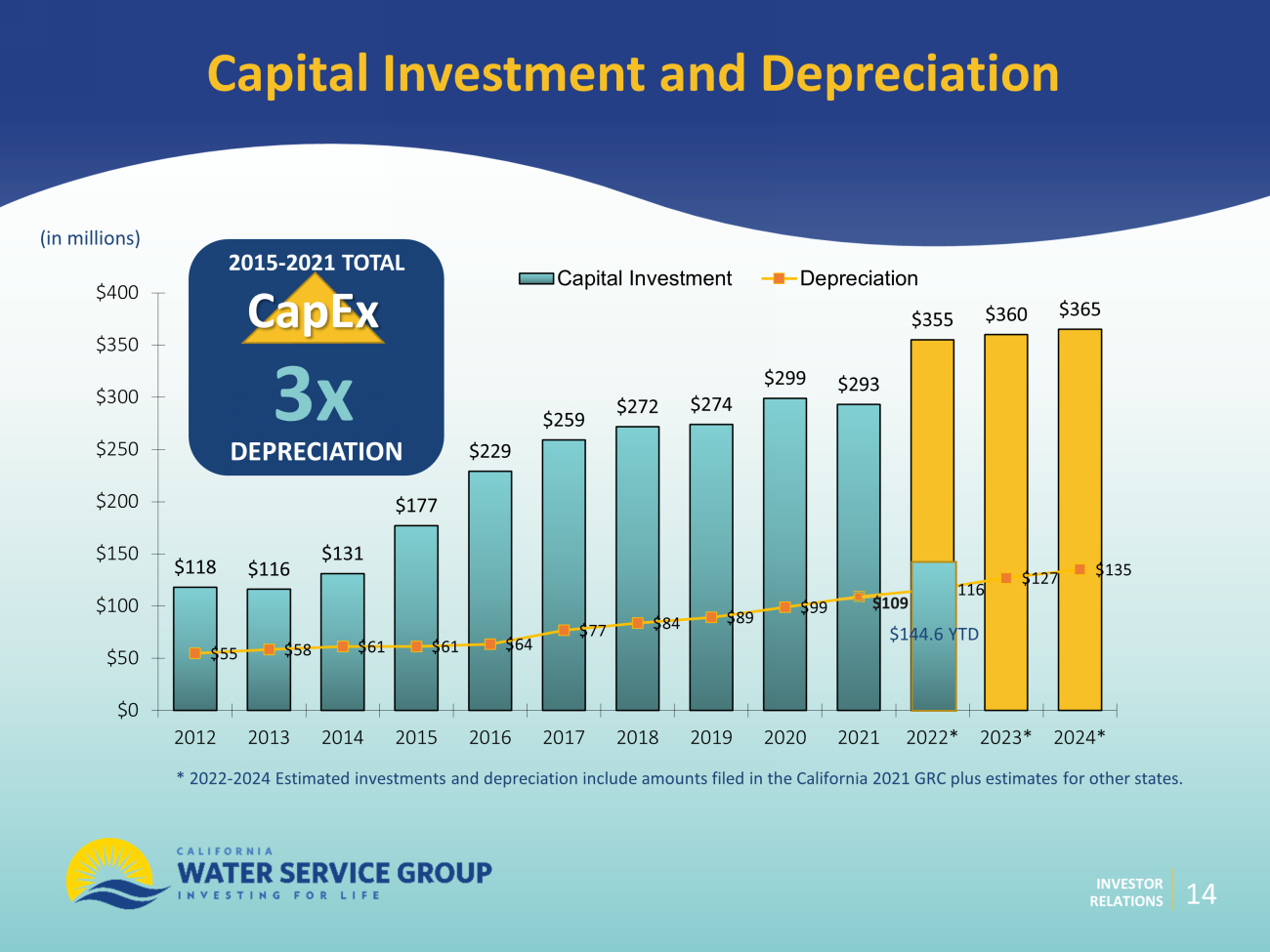

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $293 $355 $360 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $116 $127 $135 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022* 2023* 2024* Capital Investment Depreciation Capital Investment and Depreciation (in millions) * 2022 - 2024 Estimated investments and depreciation include amounts filed in the California 2021 GRC plus estimates for other sta tes. 2008 - 2019 CAGR 9.7% 2015 - 2021 TOTAL CapEx 3x DEPRECIATION $109 $144.6 YTD 14

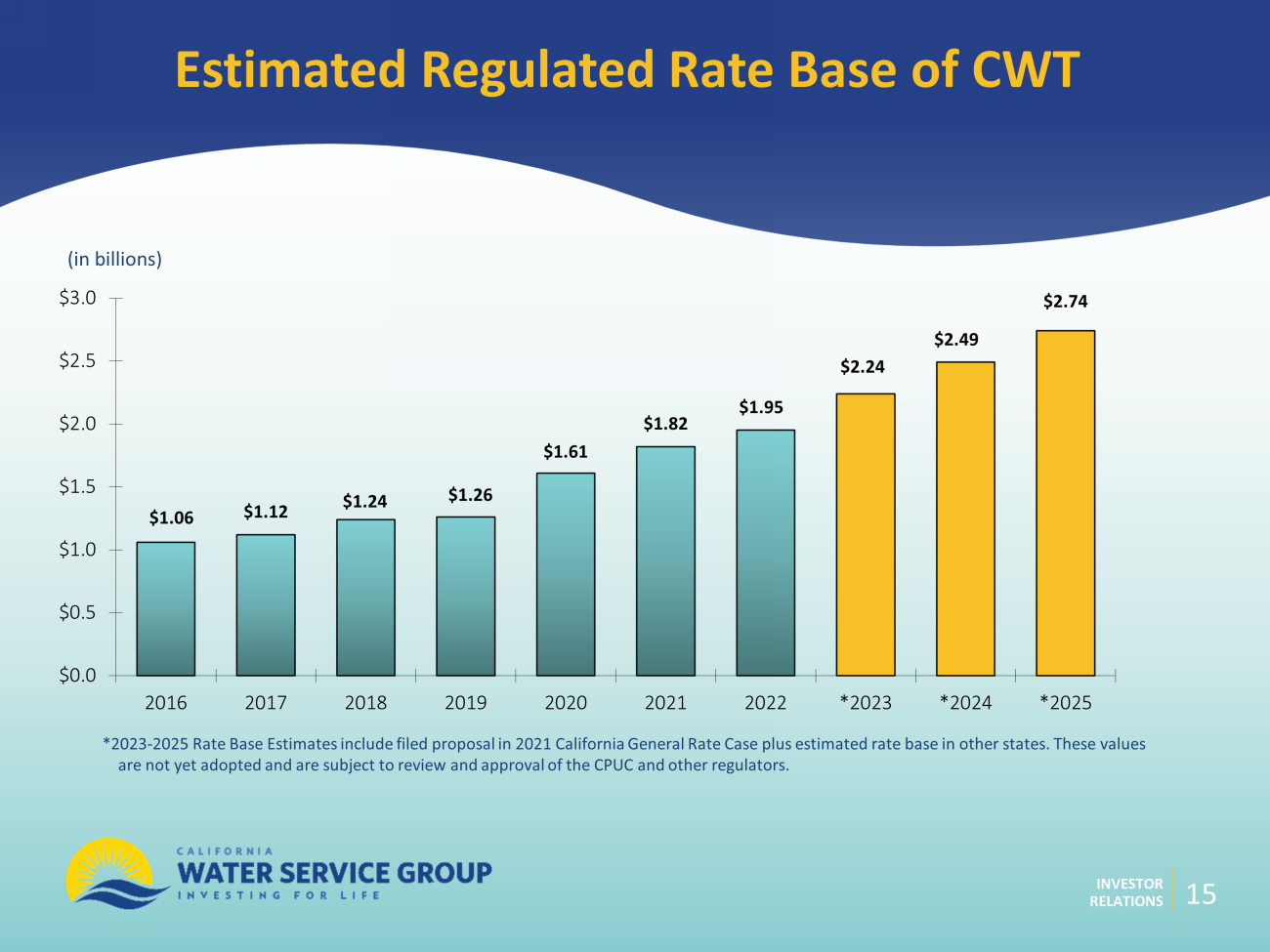

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions ) *2023 - 2025 Rate Base Estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other sta tes. These values are not yet adopted and are subject to review and approval of the CPUC and other regulators. $1.06 $1.12 $1.24 $1.61 $2.74 $1.26 $ 1.82 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 *2023 *2024 *2025 $1.95 $2.24 $2.49 15

INVESTOR RELATIONS In Summary o Change in unbilled revenue, which we expect not to materially impact full year earnings, was due to comparison with high unbilled in Q2 2021, lower water sales, and timing of meter reads o Market headwinds lowered unrealized valuation of certain retirement assets o Core business remains strong as we await regulatory outcomes in California o Management focused on drought, fire season, supply chains, and resolution of California delinquent balances o Growth opportunities remain robust 16

DISCUSSION