EXHIBIT 99.2

Published on April 28, 2022

Exhibit 99.2

0 First Quarter 2022 Results Presentation April 28, 2022

INVESTOR RELATIONS Forward - Looking Statements 1 This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("Act"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment e stablished by the Act. Forward - looking statements are based on currently available information, expectations, estimates, assumptions and projections, and ma nag ement's judgment about the Company, the water utility industry and general economic conditions. Such words as will, would, expects, intends, plans, beli eve s, may, estimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts or variations of such words or similar expressions are i nte nded to identify forward - looking statements. Forward - looking statements are not guarantees of future performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from what is contained in a forward - looking statement. Factors that may cause a result different than expect ed or anticipated include, but are not limited to: the impact of the ongoing COVID - 19 pandemic and related public health measures; our ability to invest or app ly the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commissions' decisions, including decisions on p rop er disposition of property; consequences of eminent domain actions relating to our water systems; changes in regulatory commissions' policies and procedu res , such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs in their next GRC filing (which impacted our 2021 GRC fili ng related to our operations commencing in 2023); the outcome and timeliness of regulatory commissions' actions concerning rate relief and other matters, inc luding with respect to our 2021 GRC filing; increased risk of inverse condemnation losses as a result of climate change and drought; our ability to rene w l eases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water quality standards; chang es in environmental compliance and water quality requirements; electric power interruptions, especially as a result of Public Safety Power Shutoff (PSPS) pr ogr ams; housing and customer growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with th e implementation, maintenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and threats; the ability of our enterprise risk management processes to identify or address risks adequately; labor rel ati ons matters as we negotiate with the unions; changes in customer water use patterns and the effects of conservation; our ability to complete, in a timely mann er or at all, successfully integrate and achieve anticipated benefits from announced acquisitions; the impact of weather, climate change, natural disasters, and a ctu al or threatened public health emergencies, including disease outbreaks, on our operations, water quality, water availability, water sales and operating res ult s and the adequacy of our emergency preparedness; restrictive covenants in or changes to the credit ratings on our current or future debt that could in cre ase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; risks associated with expanding our business and operations ge ogr aphically; and other risks and unforeseen events described in our SEC filings. When considering forward - looking statements, you should keep in mind the caution ary statements included in this paragraph, as well as the Annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchang e Commission (SEC). The Company assumes no obligation to provide public updates of forward - looking statements.

INVESTOR RELATIONS Today’s Participants Marty Kropelnicki President & CEO Tom Smegal Vice President, CFO & Treasurer Shannon Dean Vice President, Customer Service & Chief Citizenship Officer 2 Dave Healey Vice President, Controller

3 INVESTOR RELATIONS Presentation Overview o Our Values and Priorities o Financial Results o Financial Highlights and Earnings Bridge o California Regulatory Update o ESG Update o California Drought Update o CapEx and Supply Chain o ATM Equity Plan o Business Development Status o CapEx and Rate Base Tables o In Summary

4 BOARD UPDATE 4 BOARD UPDATE 4 INVESTOR RELATIONS

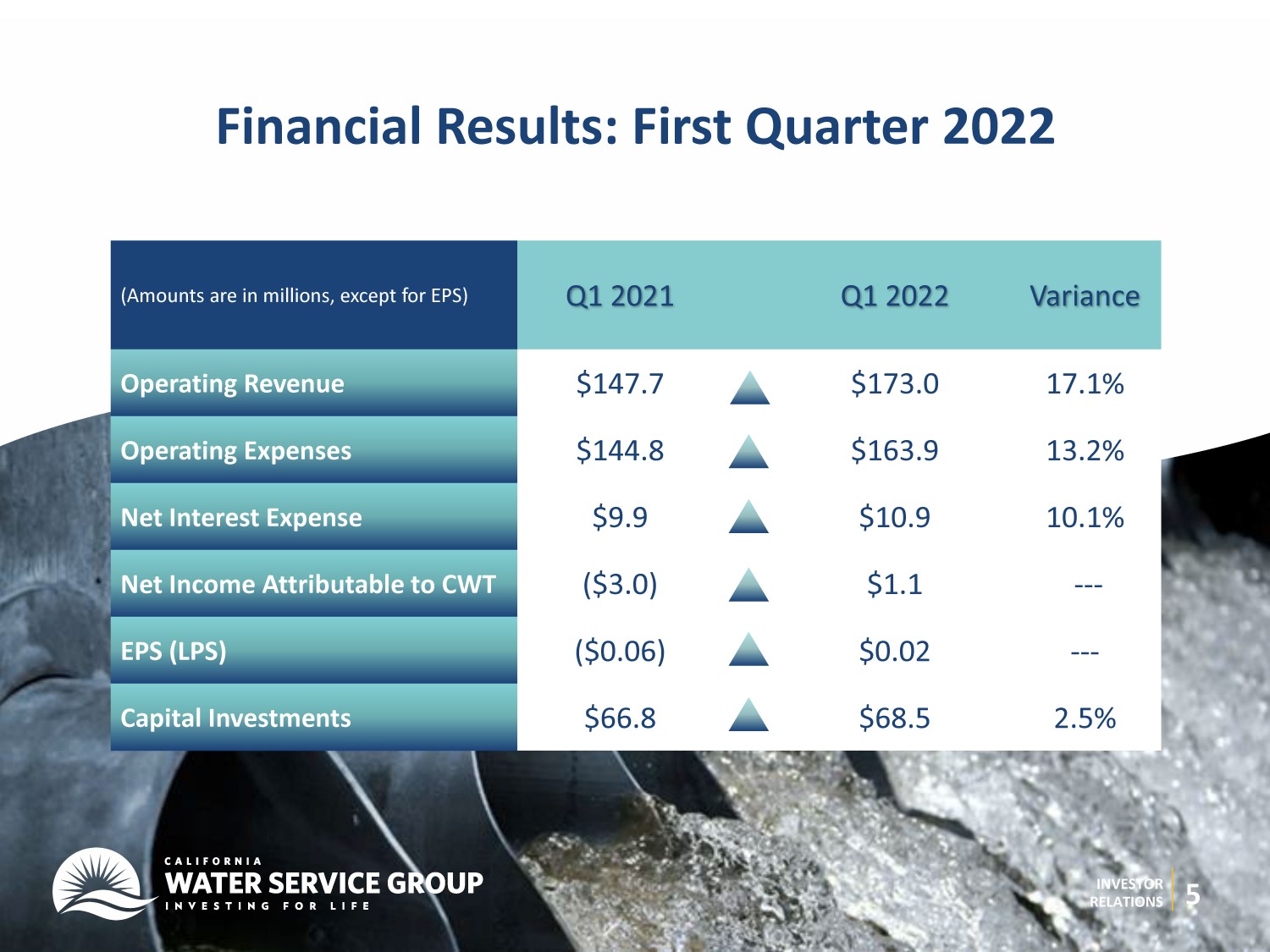

INVESTOR RELATIONS 5 (Amounts are in millions, except for EPS) Q1 2021 Q1 2022 Variance Operating Revenue $147.7 $173.0 17.1% Operating Expenses $144.8 $163.9 13.2% Net Interest Expense $9.9 $10.9 10.1% Net In come Attributable to CWT ($3.0) $1.1 --- EPS (LPS) ($0.06) $0.02 --- Capital Investments $66.8 $68.5 2.5% Financial Results: First Quarter 2022

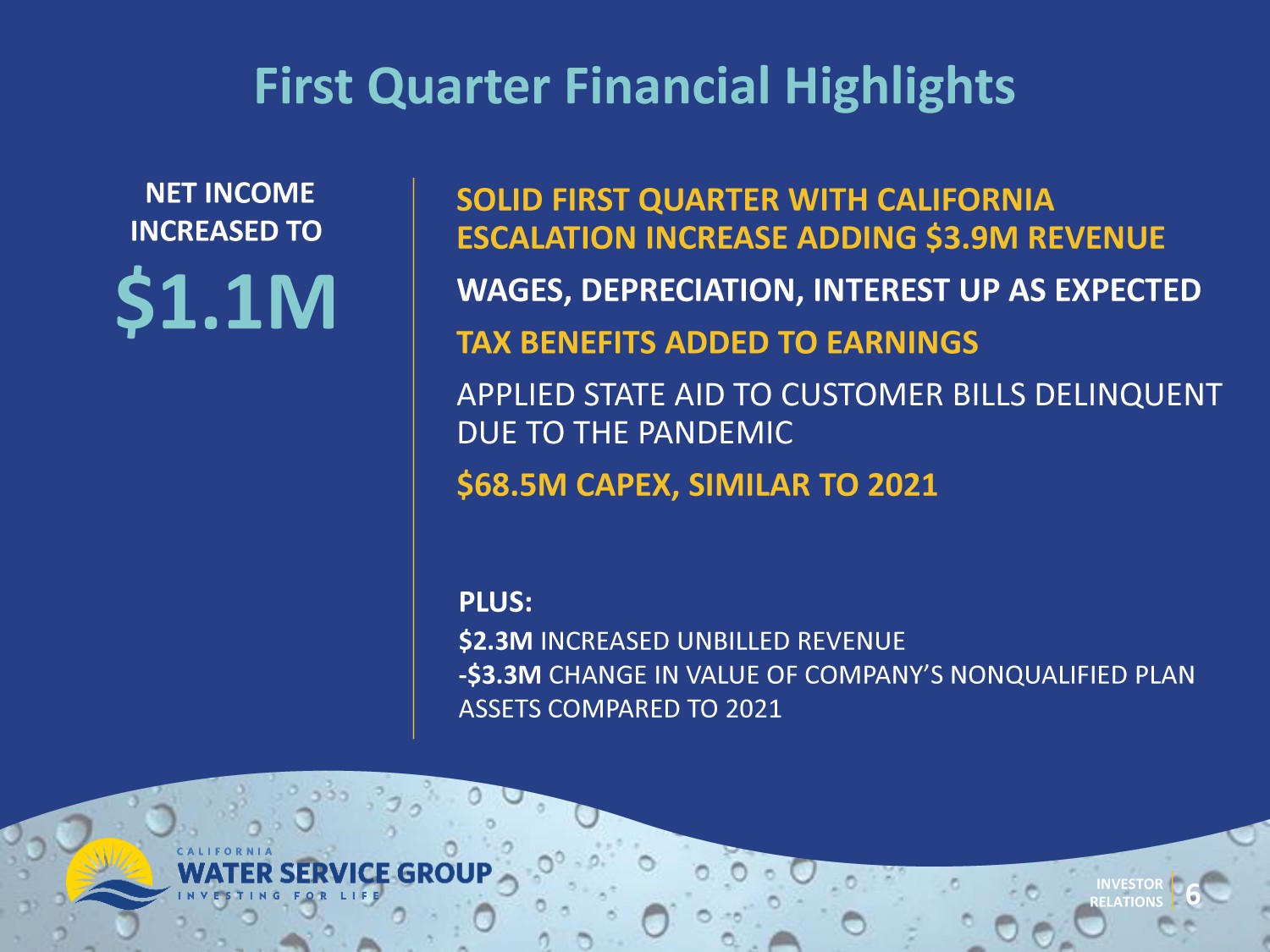

INVESTOR RELATIONS 6 SOLID FIRST QUARTER WITH CALIFORNIA ESCALATION INCREASE ADDING $3.9M REVENUE WAGES, DEPRECIATION, INTEREST UP AS EXPECTED TAX BENEFITS ADDED TO EARNINGS APPLIED STATE AID TO CUSTOMER BILLS DELINQUENT DUE TO THE PANDEMIC $68.5M CAPEX, SIMILAR TO 2021 First Quarter Financial Highlights NET INCOME INCREASED TO $1.1M PLUS: $2.3M INCREASED UNBILLED REVENUE - $3.3M CHANGE IN VALUE OF COMPANY’S NONQUALIFIED PLAN ASSETS COMPARED TO 2021

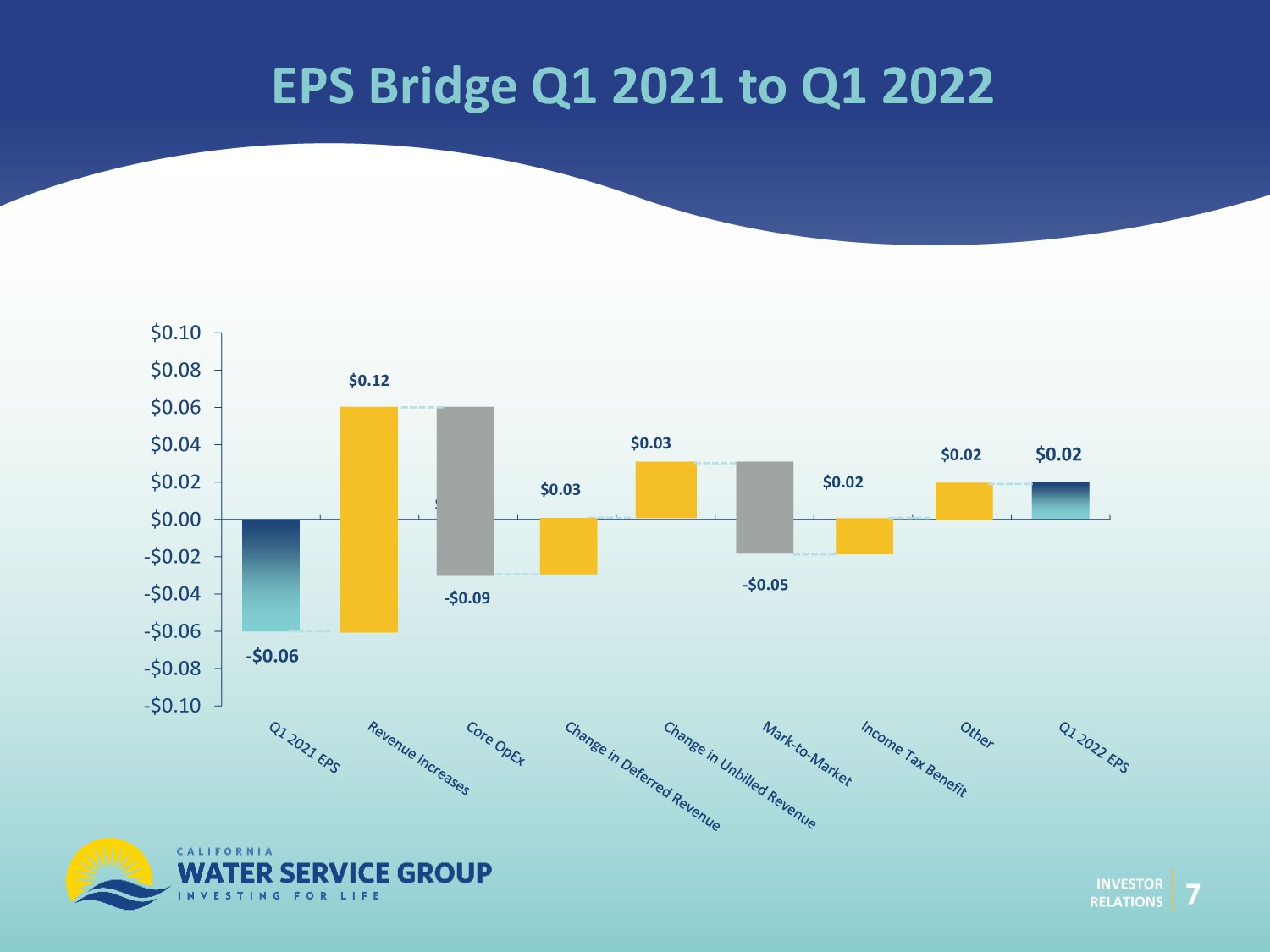

INVESTOR RELATIONS EPS Bridge Q1 2021 to Q1 2022 7 -$0.10 -$0.08 -$0.06 -$0.04 -$0.02 $0.00 $0.02 $0.04 $0.06 $0.08 $0.10 $0.02 $0.04 $0.03 $0.02 - $0.06 $0.03 - $0.09 $0.12 $0.02 - $0.05

INVESTOR RELATIONS 8 California Regulatory Update GENERAL RATE CASE CONTINUES WITH REBUTTAL TESTIMONY FILED IN APRIL. WE EXPECT TO ENGAGE IN SETTLEMENT DISCUSSIONS IN APRIL AND MAY. COST OF CAPITAL HEARINGS EXPECTED IN MAY. REBUTTAL TESTIMONY FILED IN MARCH. WE ARE UNABLE TO DETERMINE WHEN THE COST OF CAPITAL DECISION WILL BECOME EFFECTIVE THE CASE IS DELAYED AND A DECISION IS UNLIKELY BEFORE THE END OF Q3 ISSUES ARE CAPITAL STRUCTURE AND COST OF EQUITY IF THE CPUC ADOPTS THE COMPANY’S PROPOSED COST OF DEBT, THE ANNUAL IMPACT WOULD REDUCE REVENUES $11M ONCE RATES BECOME EFFECTIVE GRC, WITH A 2023 TEST YEAR, IS ANTICIPATED TO BE EFFECTIVE JANUARY 1, 2023 ISSUES INCLUDE CAPITAL INVESTMENT BUDGETS, RATE DESIGN, AND SOME EXPENSES THERE IS NOT A MAJOR DIFFERENCE BETWEEN PARTIES’ POSITIONS ON SALES AND WATER PRODUCTION MIX

INVESTOR RELATIONS 9 ESG: Bringing Strategy to Life • Updated strategic framework and corporate planning process • All - employee engagement • Short - and long - term objectives that will drive progress on o Climate Change, Energy & Emissions o Community Support o Diversity, Equality & Inclusion o Emergency Preparedness & Response o Stakeholder Engagement & Public Participation o Water Supply Management, Reliability & Resilience o End - use water conservation

INVESTOR RELATIONS 10 • Published our 2nd SASB - aligned ESG Report that references GRI and TCFD • A few highlights on execution: o Climate Risk Assessment & Adaptation Framework o In - line hydro turbine system in Waikoloa, Hawaii o Tesoro Viejo Wastewater Treatment and Recycled Water Production Plant o Smart Landscape Tune - Up program o 2021 General Rate Case design o Unconscious bias training for managers in 2021 o 16 wildfire - related projects ESG: Executing on Strategy, 2021 Highlights

INVESTOR RELATIONS EXTREMELY DRY JANUARY - MARCH IN CALIFORNIA, WITH SOME RELIEF IN APRIL STATE SURFACE WATER AVAILABILITY WILL BE LOW IN 2022, REDUCING SUPPLY OPTIONS IN SOME REGIONS CALIFORNIA CUSTOMER USAGE DOWN 2% IN Q1 AS COMPARED TO 2021 CAL WATER ANTICIPATES FURTHER DROUGHT REGULATIONS FROM THE STATE WATER BOARD IN Q2 CPUC HAS ALLOWED A TRACKING MECHANISM FOR DROUGHT COSTS BEGINNING IN 2021 ALL CAL WATER DISTRICTS LIKELY TO BE IN STAGE 2 CONSERVATION PLANS BY MID - JUNE TEAM MONITORING CONDITIONS REGULARLY 11 California Drought Update

12 INVESTOR RELATIONS Capital Spending and Supply Chain Q1 CAPEX IN LINE WITH 2021 CONSTRUCTION IS EXPERIENCING INFLATION, SUPPLY CHAIN DISRUPTIONS, LABOR SHORTAGES, AND DELAYS IN PERMITTING GLOBAL EVENTS IMPACTING SUPPLY CHAIN: UKRAINE AND CHINESE COVID LOCKDOWNS NON - RESPONSIVE BIDDERS AND CONSTRUCTION DELAYS DUE TO CONSTRUCTION LABOR SHORTAGES PERMITTING DELAYS DUE TO COVID AND VOLUME OF PROJECTS MITIGATION PLANS INCLUDE ORDERING MATERIALS EARLY FOR PROJECTS, STRATEGIC SOURCING, CONTRACTOR AND STAKEHOLDER OUTREACH NOT YET IMPACTING ANNUAL CAPEX BUT CLOSELY MONITORING DEVELOPMENTS

13 INVESTOR RELATIONS ATM Equity Plan Renewal We expect to renew our ATM equity program in the near term We expect the new program will allow us to raise up to $350M over three years Proceeds will be used for general corporate purposes Company will continue to issue long - term debt from time to time The expiring ATM program raised $300M and was completed in Q4 2021

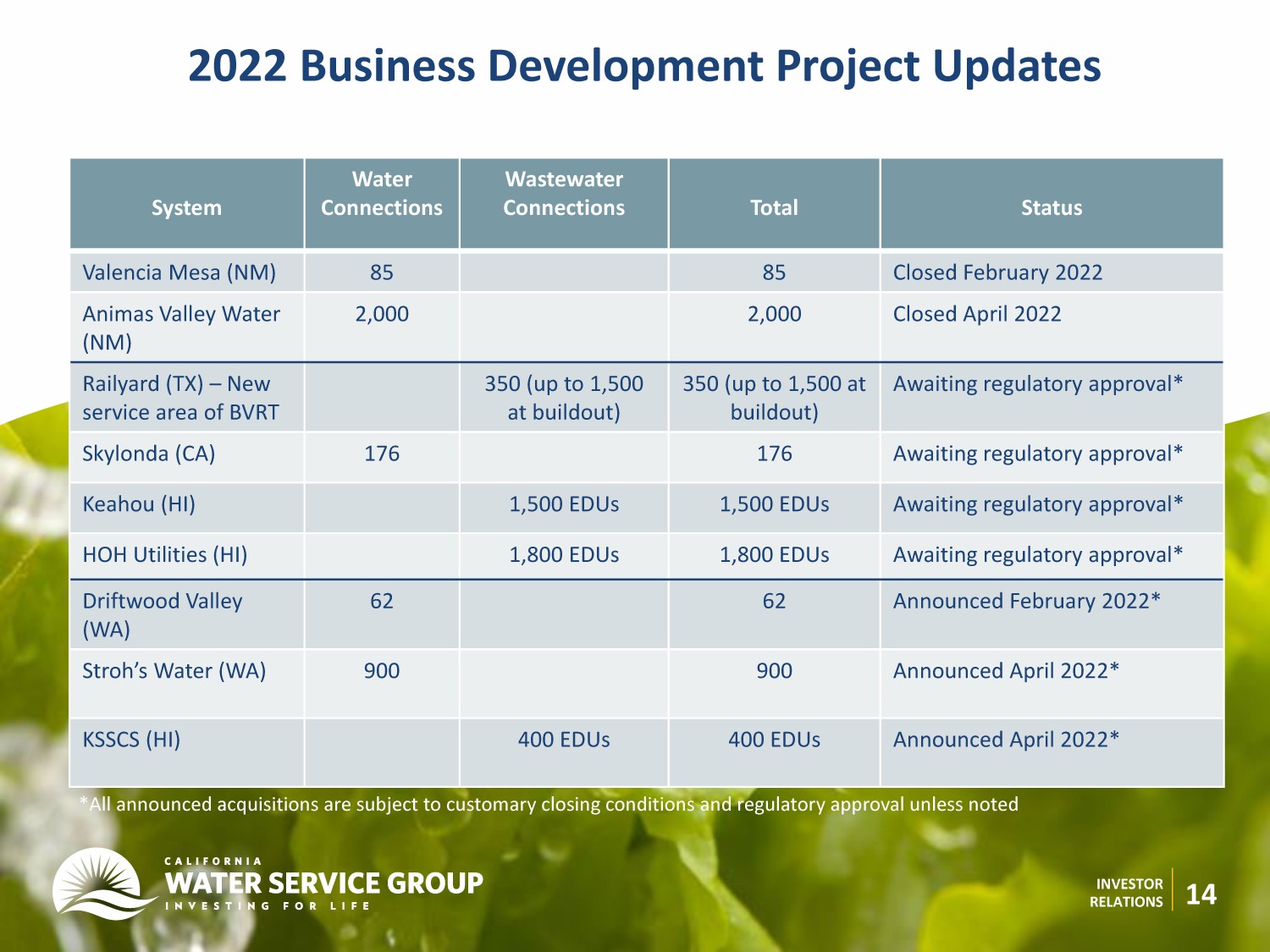

INVESTOR RELATIONS 14 2022 Business Development Project Updates System Water Connections Wastewater Connections Total Status Valencia Mesa (NM) 85 85 Closed February 2022 Animas Valley Water (NM) 2,000 2,000 Closed April 2022 Railyard (TX) – New service area of BVRT 350 (up to 1,500 at buildout) 350 (up to 1,500 at buildout) Awaiting regulatory approval* Skylonda (CA) 176 176 Awaiting regulatory approval* Keahou (HI) 1,500 EDUs 1,500 EDUs Awaiting regulatory approval * HOH Utilities (HI) 1,800 EDUs 1,800 EDUs Awaiting regulatory approval* Driftwood Valley (WA) 62 62 Announced February 2022* Stroh’s Water (WA) 900 900 Announced April 2022* KSSCS (HI) 400 EDUs 400 EDUs Announced April 2022* *All announced acquisitions are subject to customary closing conditions and regulatory approval unless noted

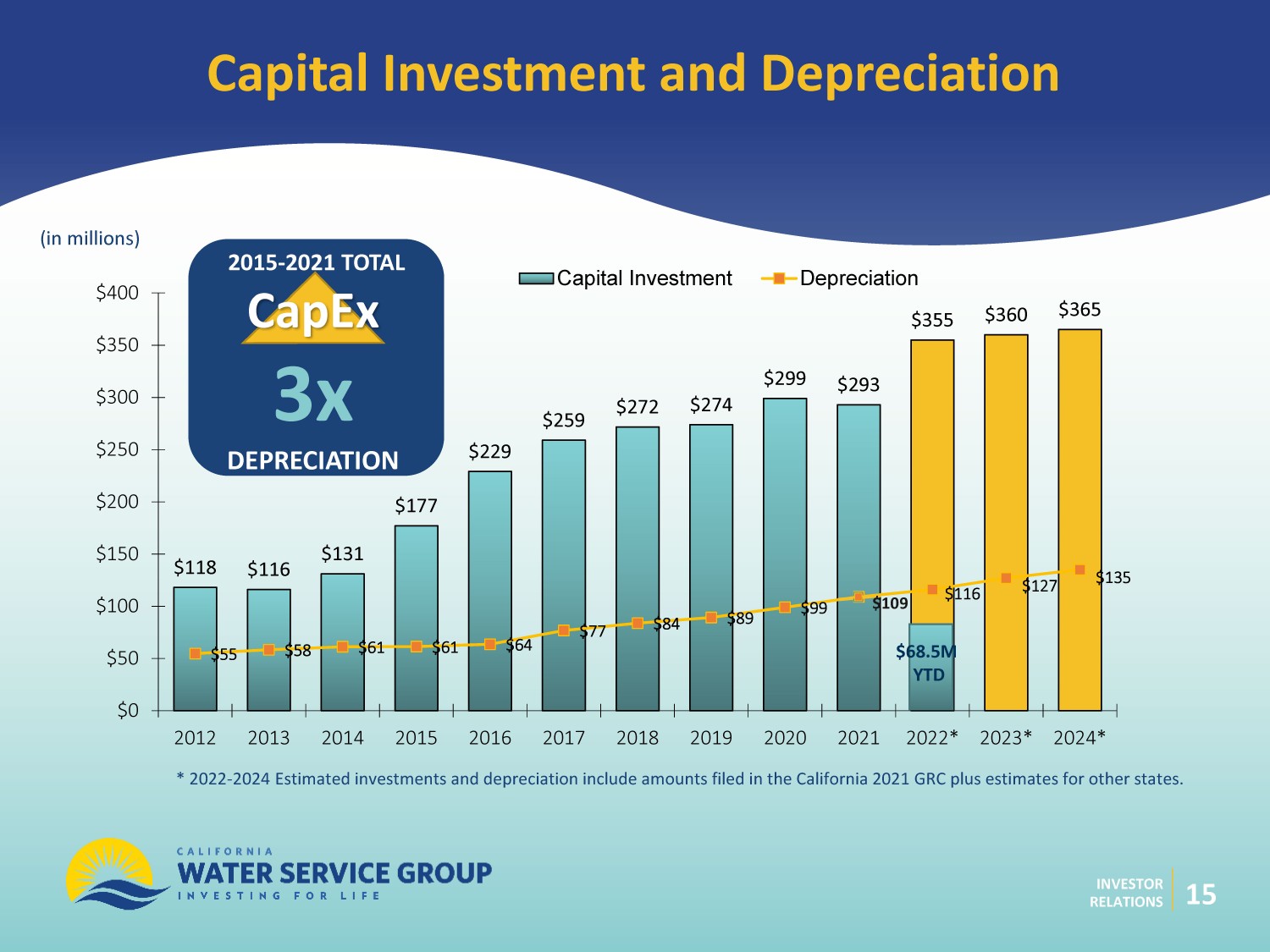

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $293 $355 $360 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $116 $127 $135 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022* 2023* 2024* Capital Investment Depreciation Capital Investment and Depreciation 15 (in millions) * 2022 - 2024 Estimated investments and depreciation include amounts filed in the California 2021 GRC plus estimates for other sta tes. 2008 - 2019 CAGR 9.7% 2015 - 2021 TOTAL CapEx 3x DEPRECIATION $109 $68.5M YTD

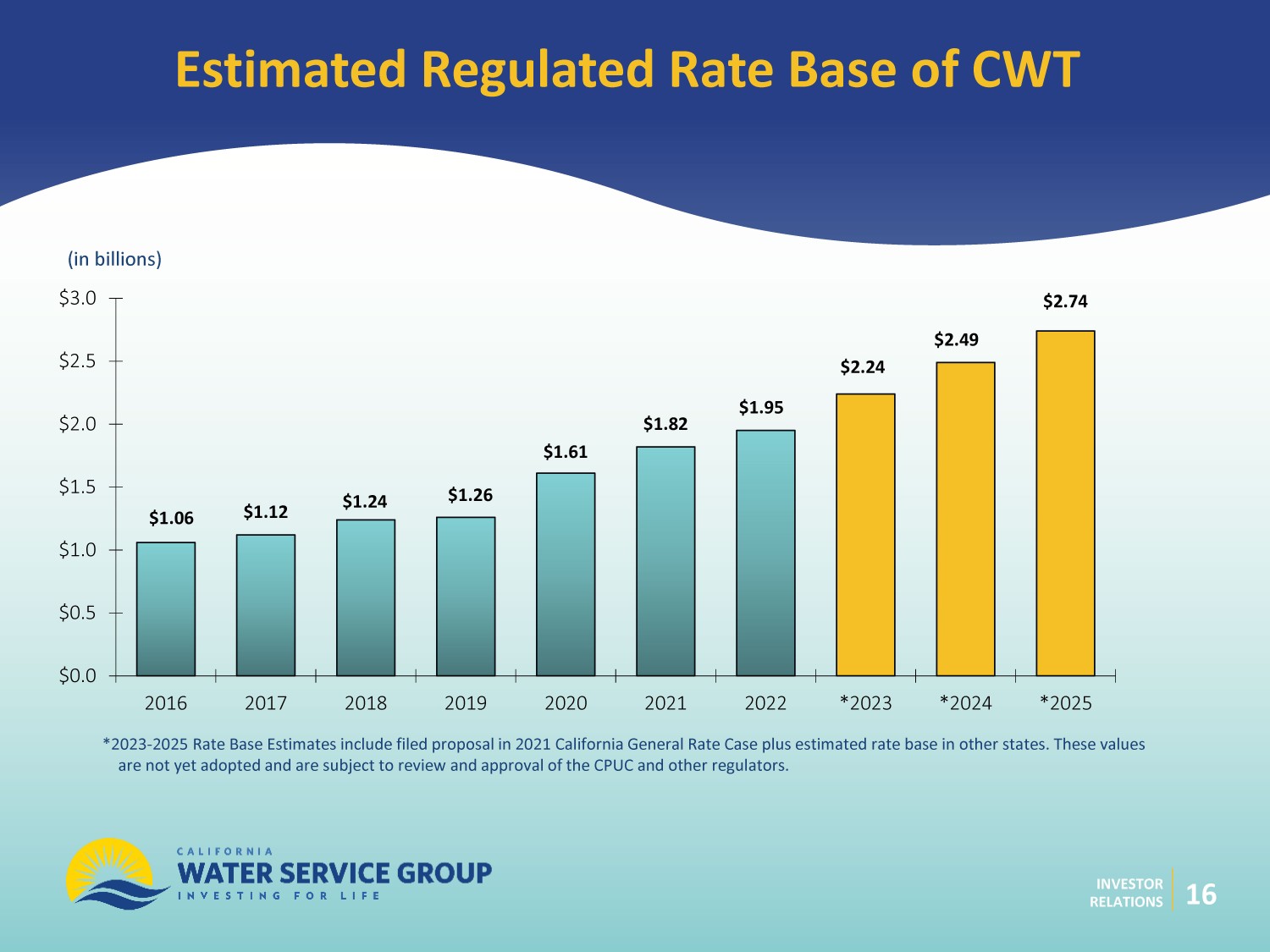

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions) *2023 - 2025 Rate Base Estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other sta tes. These values are not yet adopted and are subject to review and approval of the CPUC and other regulators. 16 $1.06 $1.12 $1.24 $1.61 $2.74 $1.26 $1.82 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 *2023 *2024 *2025 $1.95 $2.24 $2.49

17 INVESTOR RELATIONS In Summary o Solid first quarter performance o Excited about the ESG progress we’re making o We continue to grow through acquisitions o Focus of the company is on drought, regulatory proceedings, and working through disruptions

DISCUSSION