EXHIBIT 99.2

Published on February 24, 2022

Exhibit 99.2

0 Full Year & Fourth Quarter 2021 Results Presentation February 24, 2022

INVESTOR RELATIONS Such words as would, expects, intends, plans, believes, may, estimates, assumes, anticipates, projects, predicts, targets, forecasts, priorities, outlook or variations of such words or similar expressions are intended to identify forward - looking statements. The forward - looking stateme nts are not guarantees of future performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from wha t is contained in a forward - looking statement. Factors that may cause a result different than expected or anticipated include, but are not limited t o: the impact of the ongoing COVID - 19 pandemic and related public health measures; our ability to invest or apply the proceeds from the issuance of c ommon stock in an accretive manner ; governmental and regulatory commissions' decisions, including decisions on proper disposition of property; co nsequences of eminent domain actions relating to our water systems; changes in regulatory commissions' policies and procedures; the outcome and tim eli ness of regulatory commissions' actions concerning rate relief and other matters; increased risk of inverse condemnation losses as a result of c lim ate conditions; inability to renew leases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Contro l B oard water quality standards; changes in environmental compliance and water quality requirements; electric power interruptions; housing and cust ome r growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with the impleme nta tion, maintenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitig ate physical and cyber security risks and threats; the ability of our enterprise risk management processes to identify or address risks adequately; labor rel ati ons matters as we negotiate with the unions; changes in customer water use patterns and the effects of conservation; our ability to complete, successfull y i ntegrate and achieve anticipated benefits form announced acquisitions; the impact of weather, climate, natural disasters, and actual or threatened pu blic health emergencies, including disease outbreaks, on our operations, water quality, water availability, water sales and operating results and the ade quacy of our emergency preparedness; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our fi nancing costs or affect our ability to borrow, make payments on debt or pay dividends; and, other risks and unforeseen events. When considering forward - loo king statements, you should keep in mind the cautionary statements included in this paragraph, as well as the annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchange Commission. The Company assumes no obligation to provide public updates of forward - looking statements. Forward - Looking Statements 1 This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("Act"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatme nt established by the Act. Forward - looking statements are based on currently available information, expectations, estimates, assumptions and projectio ns, and management's judgment about the Company, the water utility industry and general economic conditions.

INVESTOR RELATIONS Today’s Participants Marty Kropelnicki President & CEO Tom Smegal Vice President, CFO & Treasurer Paul Townsley Vice President, Corporate Development 2 Dave Healey Vice President, Controller

3 INVESTOR RELATIONS Presentation Overview o Our Values and Priorities o Financial Results o Earnings Breakdown for 2021 o Anticipated Factors in 2022 Results o California GRC Update o California Cost of Capital and Financing Update o California Drought Update o Business Development Status and Recap o ESG Update o CapEx and Rate Base Tables o 2022 Business Priorities o In Summary

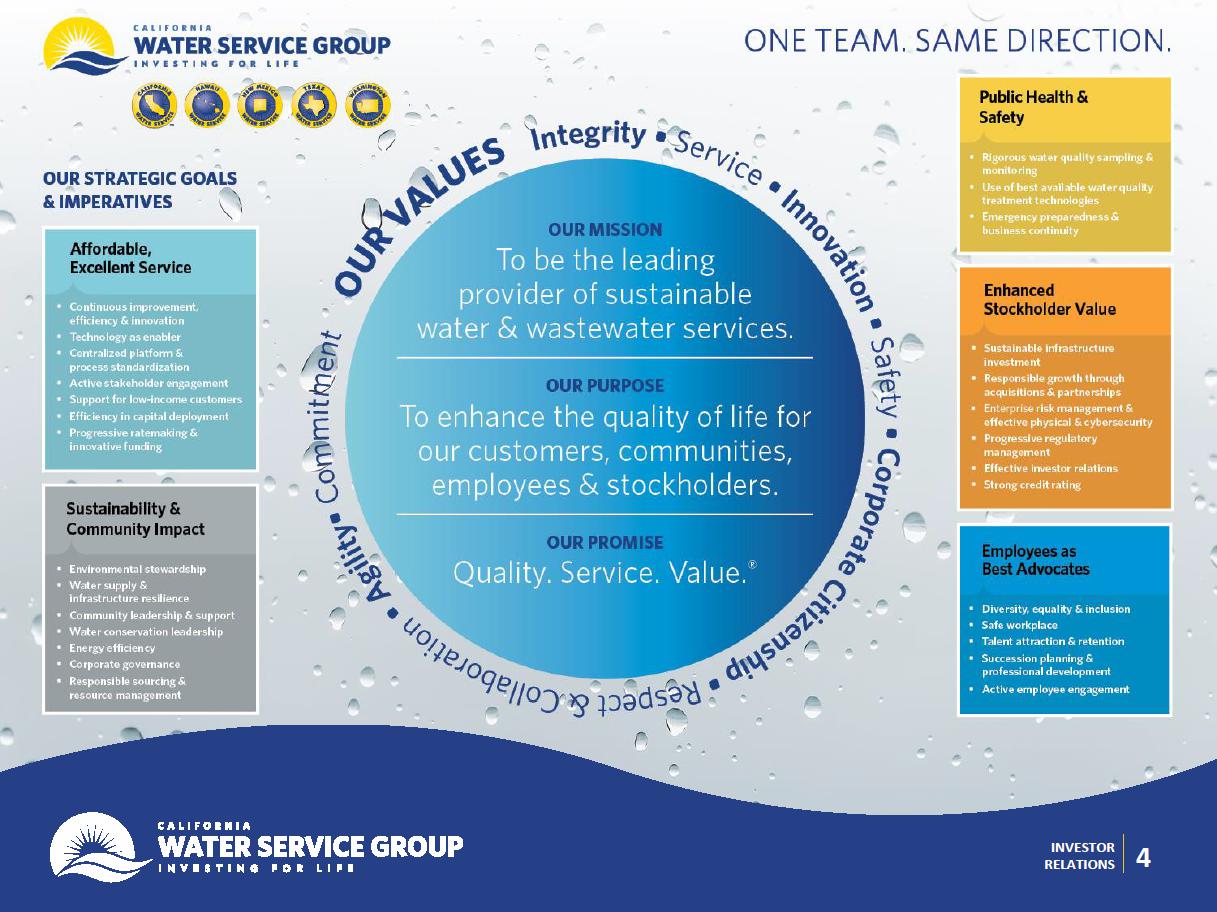

4 BOARD UPDATE 4 BOARD UPDATE 4 INVESTOR RELATIONS

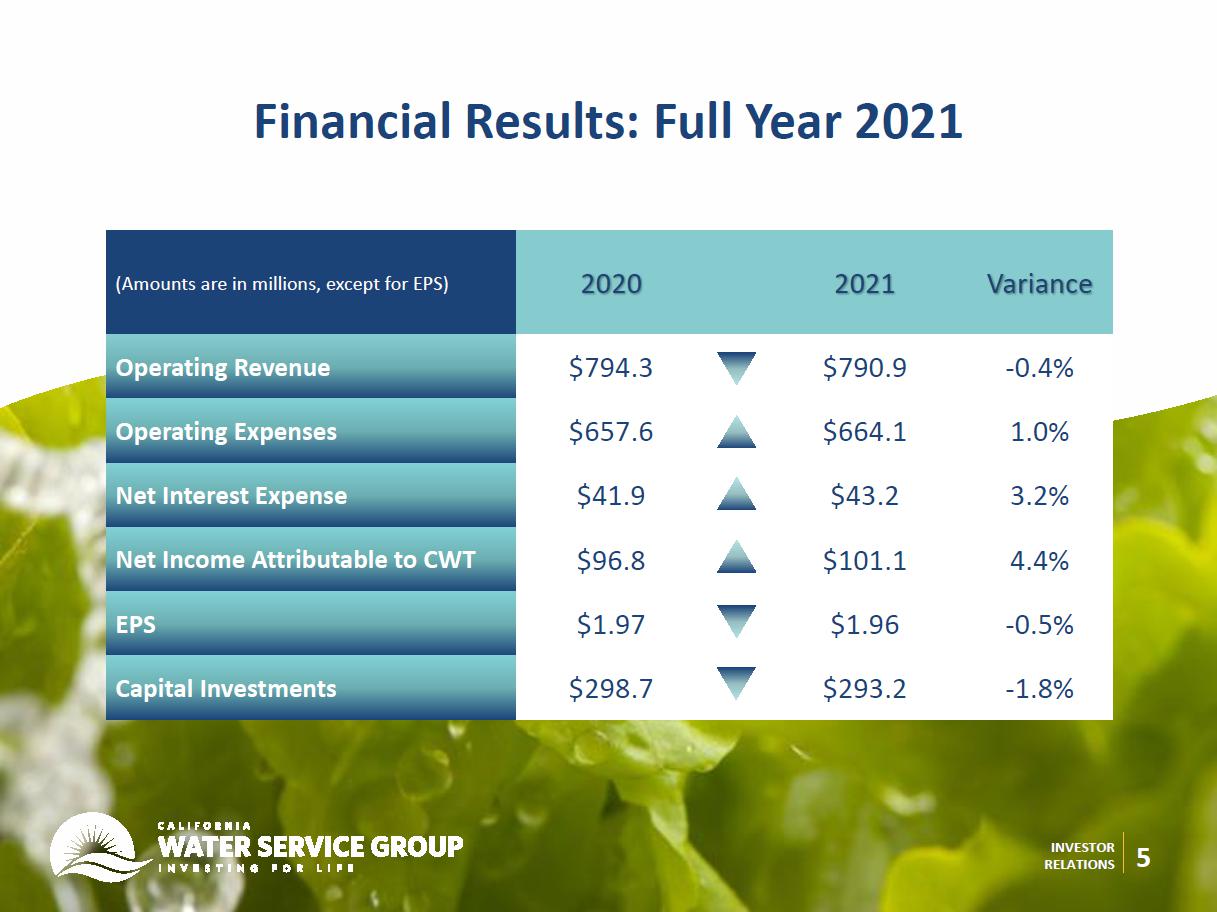

INVESTOR RELATIONS 5 Financial Results: Full Year 2021 (Amounts are in millions, except for EPS) 2020 2021 Variance Operating Revenue $794.3 $790.9 - 0.4% Operating Expenses $657.6 $664.1 1.0% Net Interest Expense $41.9 $43.2 3.2% Net In come Attributable to CWT $96.8 $101.1 4.4% EPS $1.97 $1.96 - 0.5% Capital Investments $298.7 $293.2 - 1.8%

INVESTOR RELATIONS 6 (Amounts are in millions, except for EPS) Q4 2020 Q4 2021 Variance Operating Revenue $189.2 $173.3 - 8.4% Operating Expenses $164.1 $162.9 - 0.8% Net Interest Expense $11.0 $11.3 2.4% Net In come Attributable to CWT $15.5 $3.5 - 77.4% EPS $0.31 $0.07 - 77.4% Capital Investments $77.4 $85.4 10.3% Financial Results: Fourth Quarter 2021

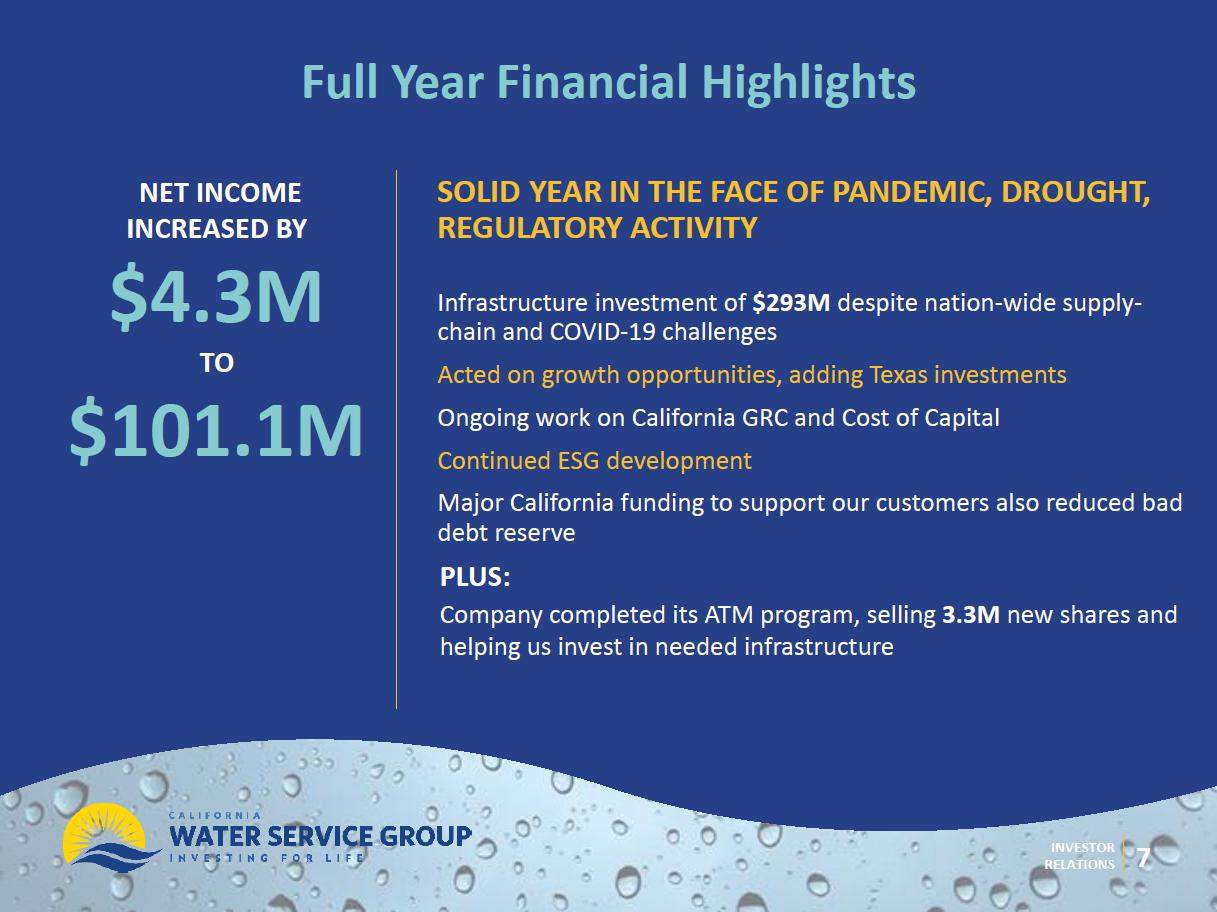

INVESTOR RELATIONS 7 SOLID YEAR IN THE FACE OF PANDEMIC, DROUGHT, REGULATORY ACTIVITY Infrastructure investment of $293M despite nation - wide supply - chain and COVID - 19 challenges Acted on growth opportunities, adding Texas investments Ongoing work on California GRC and Cost of Capital Continued ESG development Major California funding to support our customers also reduced bad debt reserve Full Year Financial Highlights NET INCOME INCREASED BY $4.3M TO $101.1M PLUS: Company completed its ATM program, selling 3.3M new shares and helping us invest in needed infrastructure CONFIDENTIAL – WORK IN PROGRESS

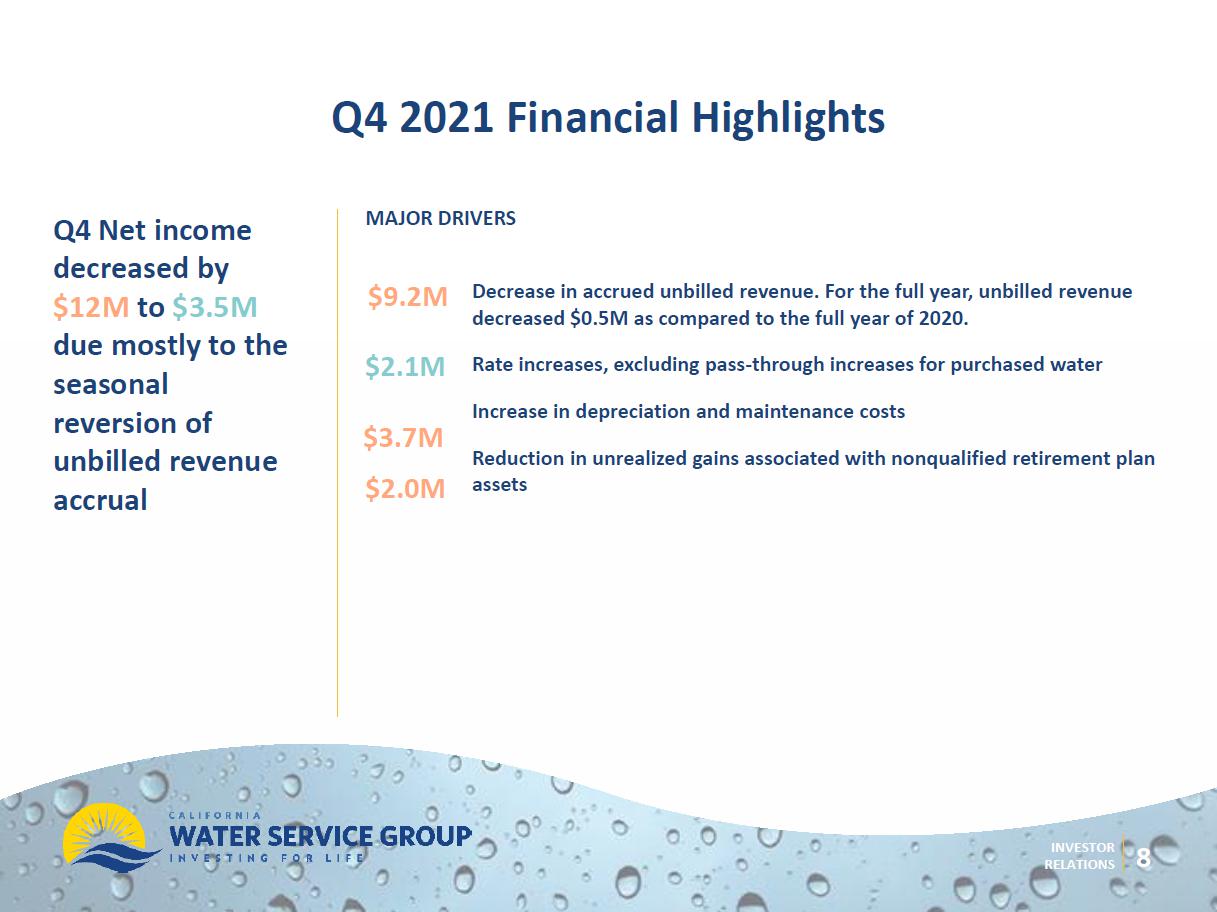

INVESTOR RELATIONS 8 Q4 2021 Financial Highlights MAJOR DRIVERS Decrease in accrued unbilled revenue. For the full year, unbilled revenue decreased $0.5M as compared to the full year of 2020. Rate increases, excluding pass - through increases for purchased water Increase in depreciation and maintenance costs Reduction in unrealized gains associated with nonqualified retirement plan assets Q4 Net income decreased by $12M to $3.5M due mostly to the seasonal reversion of unbilled revenue accrual $9.2M $2.1M $3.7M $2.0M

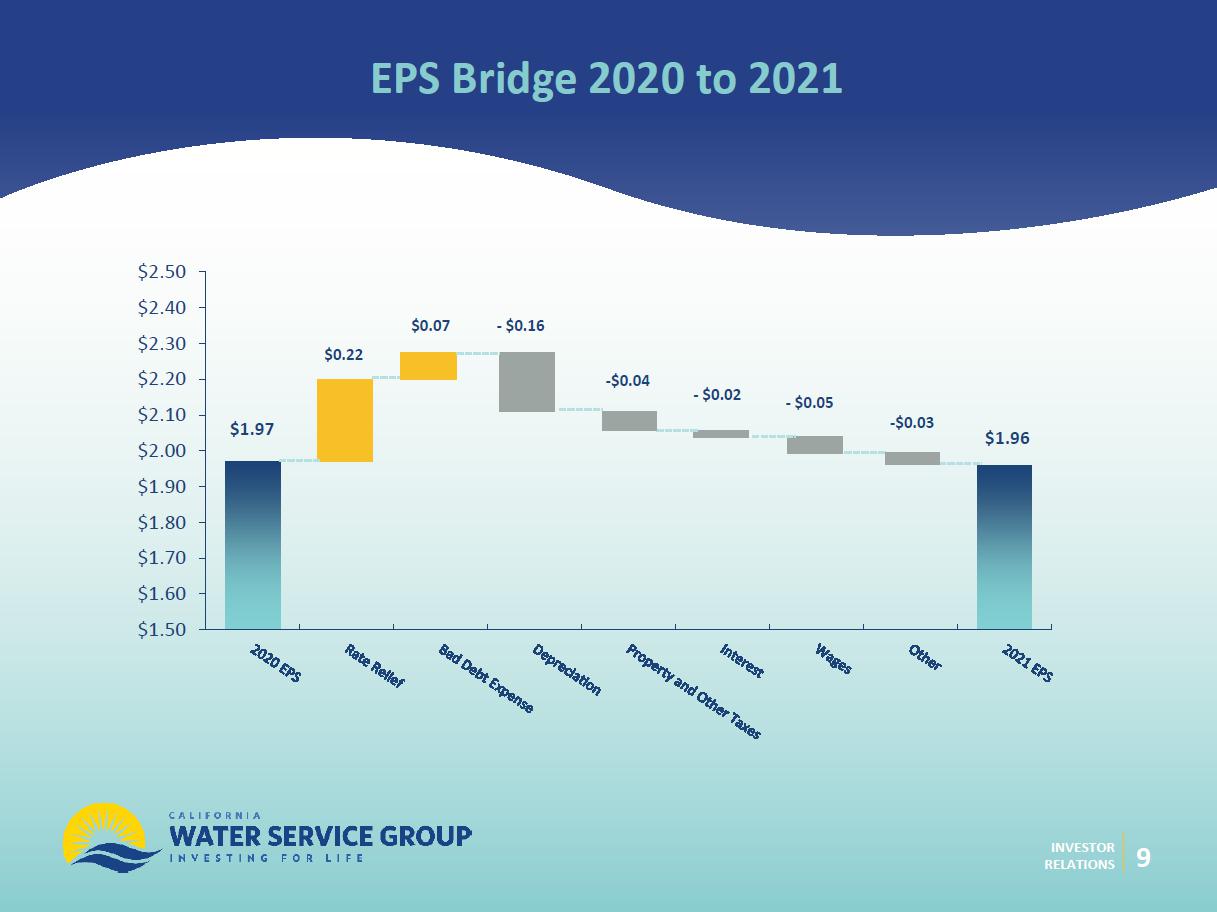

INVESTOR RELATIONS EPS Bridge 2020 to 2021 9 $1.50 $1.60 $1.70 $1.80 $1.90 $2.00 $2.10 $2.20 $2.30 $2.40 $2.50 - $0.03 - $ 0.16 - $ 0.05 - $0.04 $1.97 $0.07 - $ 0.02 $0.22 $1.96

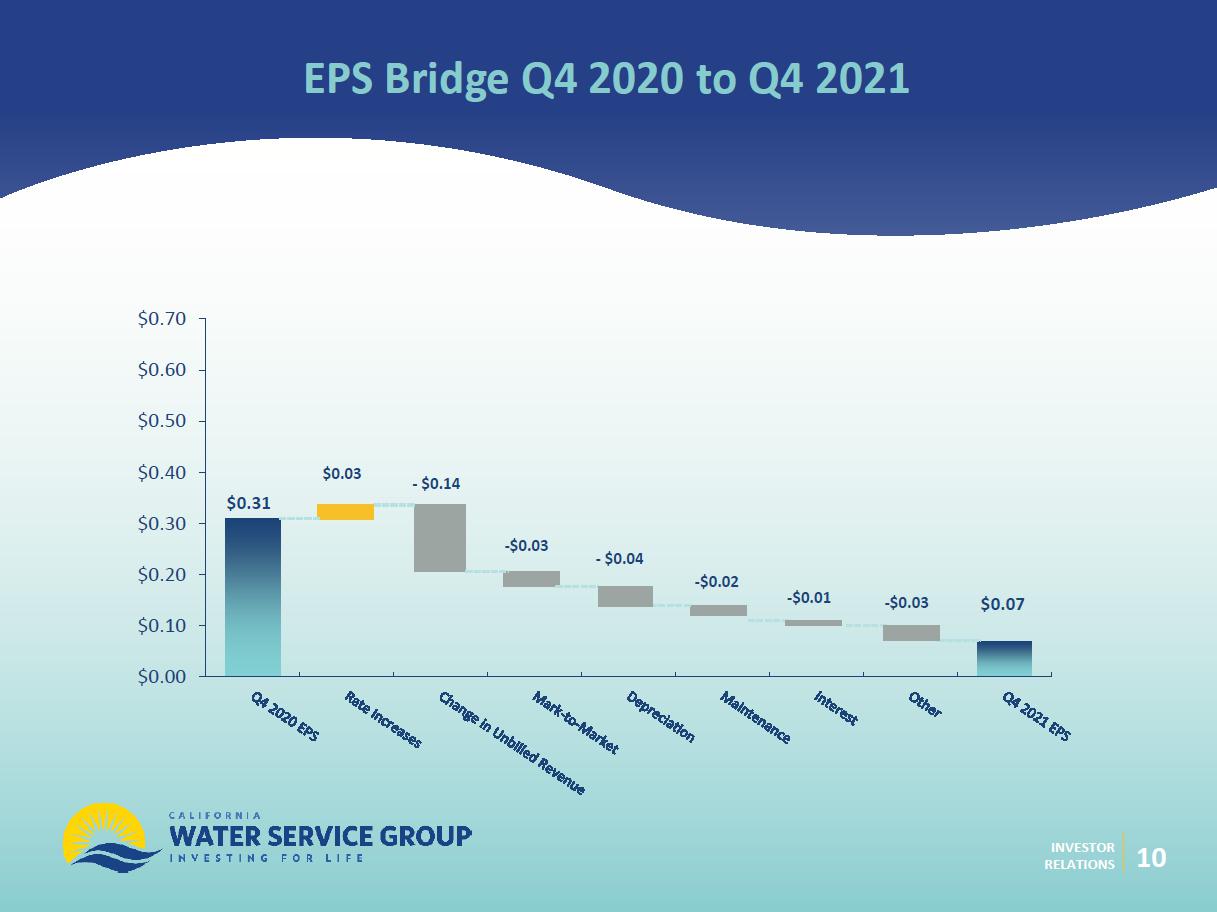

INVESTOR RELATIONS EPS Bridge Q4 2020 to Q4 2021 10 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 - $0.03 - $ 0.14 - $ 0.04 - $0.01 $0.31 - $0.03 - $0.02 $0.03 $0.07

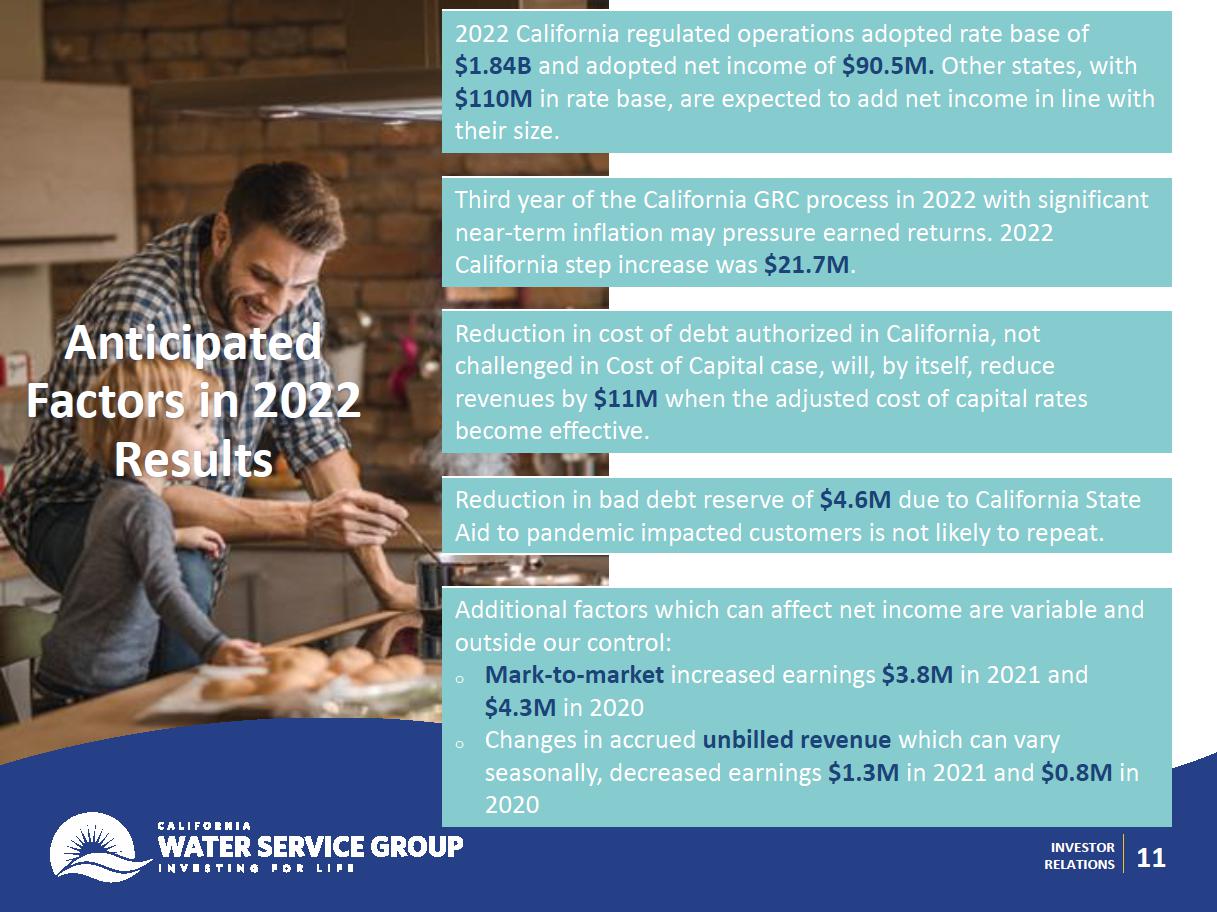

11 INVESTOR RELATIONS Anticipated Factors in 2022 Results 2022 California regulated operations adopted rate base of $1.84B and adopted net income of $90.5M. Other states, with $110M in rate base, are expected to add net income in line with their size. Third year of the California GRC process in 2022 with significant near - term inflation may pressure earned returns. 2022 California step increase was $21.7M . Reduction in cost of debt authorized in California, not challenged in Cost of Capital case, will, by itself, reduce revenues by $11M when the adjusted cost of capital rates become effective. Reduction in bad debt reserve of $4.6M due to California State Aid to pandemic impacted customers is not likely to repeat. Additional factors which can affect net income are variable and outside our control: o Mark - to - market increased earnings $3.8M in 2021 and $4.3M in 2020 o Changes in accrued unbilled revenue which can vary seasonally, decreased earnings $1.3M in 2021 and $0.8M in 2020

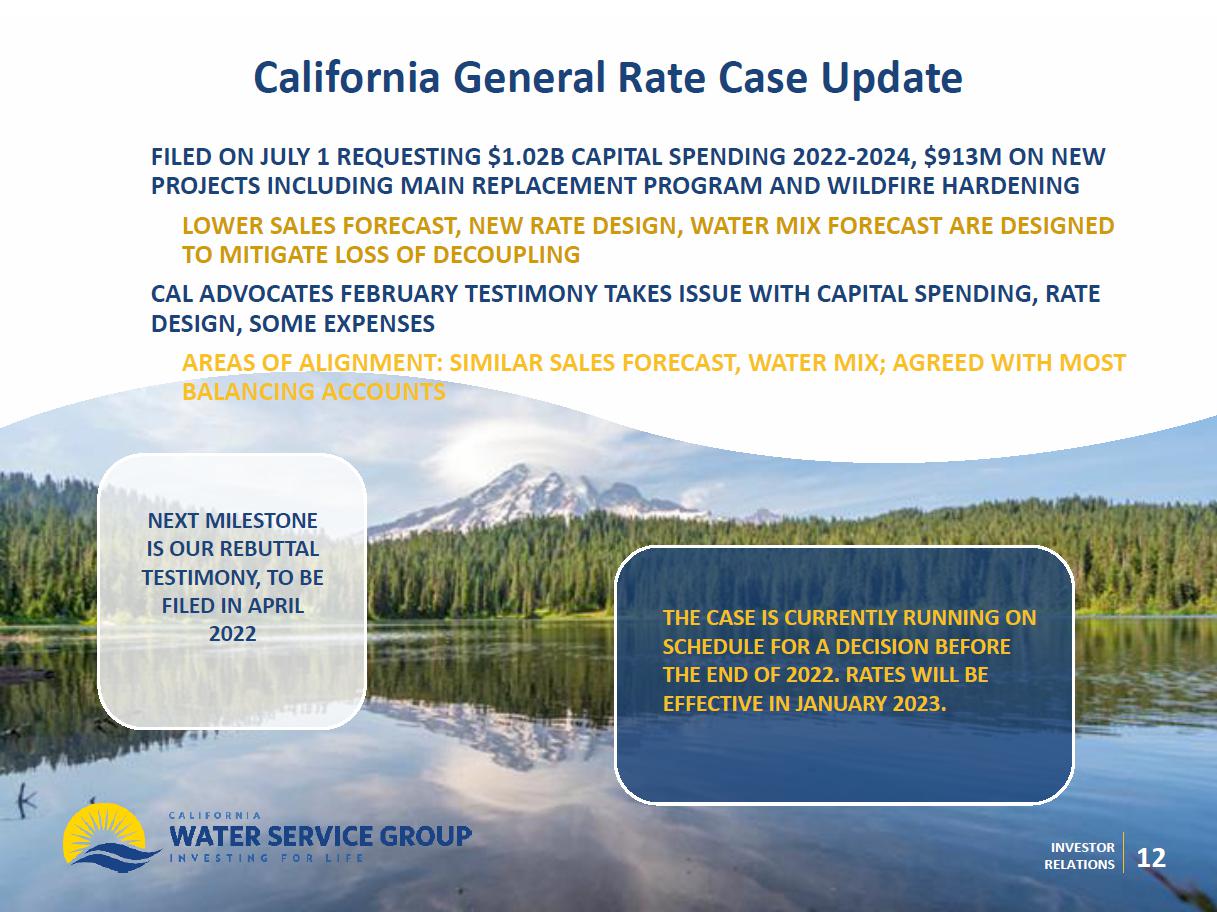

INVESTOR RELATIONS 12 California General Rate Case Update FILED ON JULY 1 REQUESTING $1.02B CAPITAL SPENDING 2022 - 2024, $913M ON NEW PROJECTS INCLUDING MAIN REPLACEMENT PROGRAM AND WILDFIRE HARDENING LOWER SALES FORECAST, NEW RATE DESIGN, WATER MIX FORECAST ARE DESIGNED TO MITIGATE LOSS OF DECOUPLING CAL ADVOCATES FEBRUARY TESTIMONY TAKES ISSUE WITH CAPITAL SPENDING, RATE DESIGN, SOME EXPENSES AREAS OF ALIGNMENT : SIMILAR SALES FORECAST, WATER MIX; AGREED WITH MOST BALANCING ACCOUNTS THE CASE IS CURRENTLY RUNNING ON SCHEDULE FOR A DECISION BEFORE THE END OF 2022. RATES WILL BE EFFECTIVE IN JANUARY 2023. NEXT MILESTONE IS OUR REBUTTAL TESTIMONY, TO BE FILED IN APRIL 2022

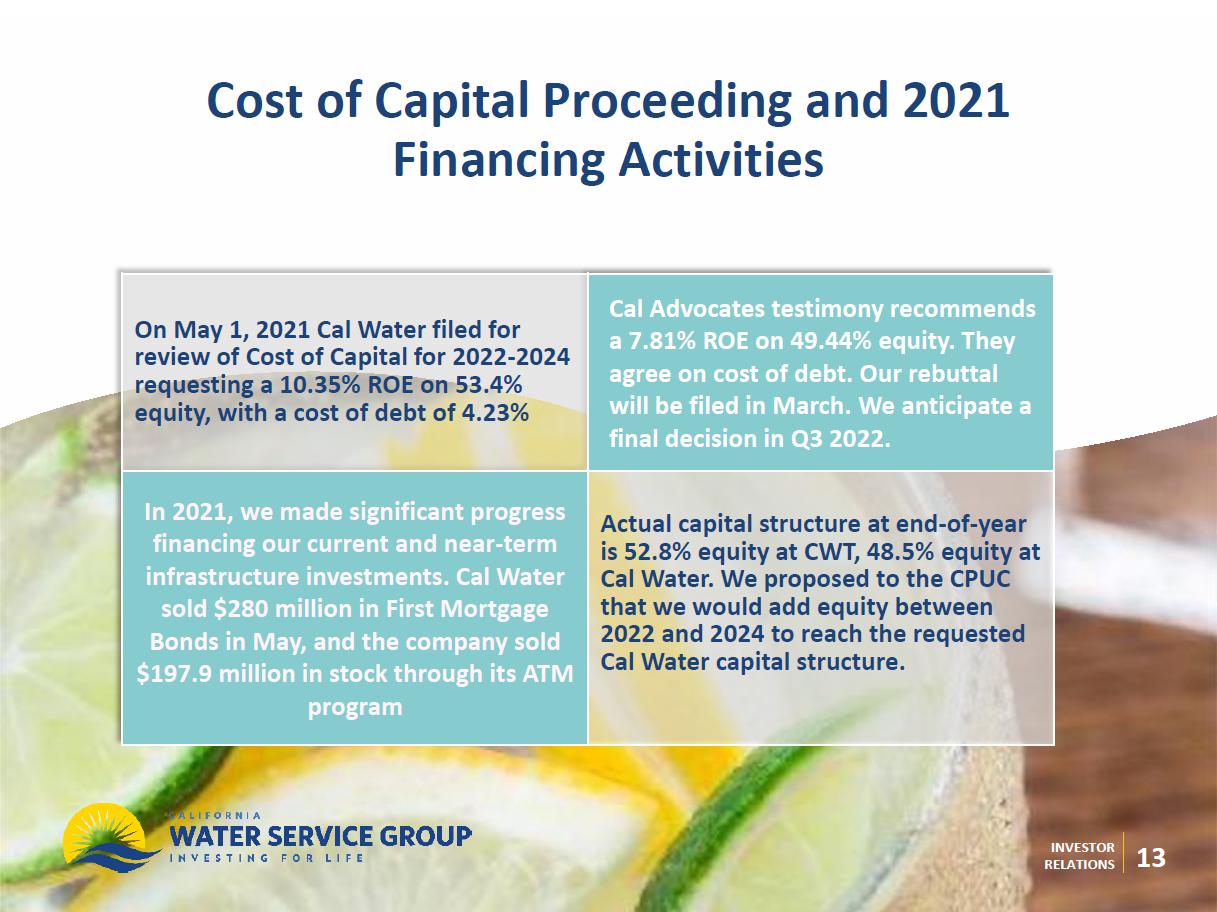

INVESTOR RELATIONS 13 Cost of Capital Proceeding and 2021 Financing Activities On May 1, 2021 Cal Water filed for review of Cost of Capital for 2022 - 2024 requesting a 10.35% ROE on 53.4% equity, with a cost of debt of 4.23% Cal Advocates testimony recommends a 7.81% ROE on 49.44% equity. They agree on cost of debt. Our rebuttal will be filed in March. We anticipate a final decision in Q3 2022. In 2021, we made significant progress financing our current and near - term infrastructure investments. Cal Water sold $280 million in First Mortgage Bonds in May, and the company sold $197.9 million in stock through its ATM program Actual capital structure at end - of - year is 52.8% equity at CWT, 48.5% equity at Cal Water. We proposed to the CPUC that we would add equity between 2022 and 2024 to reach the requested Cal Water capital structure.

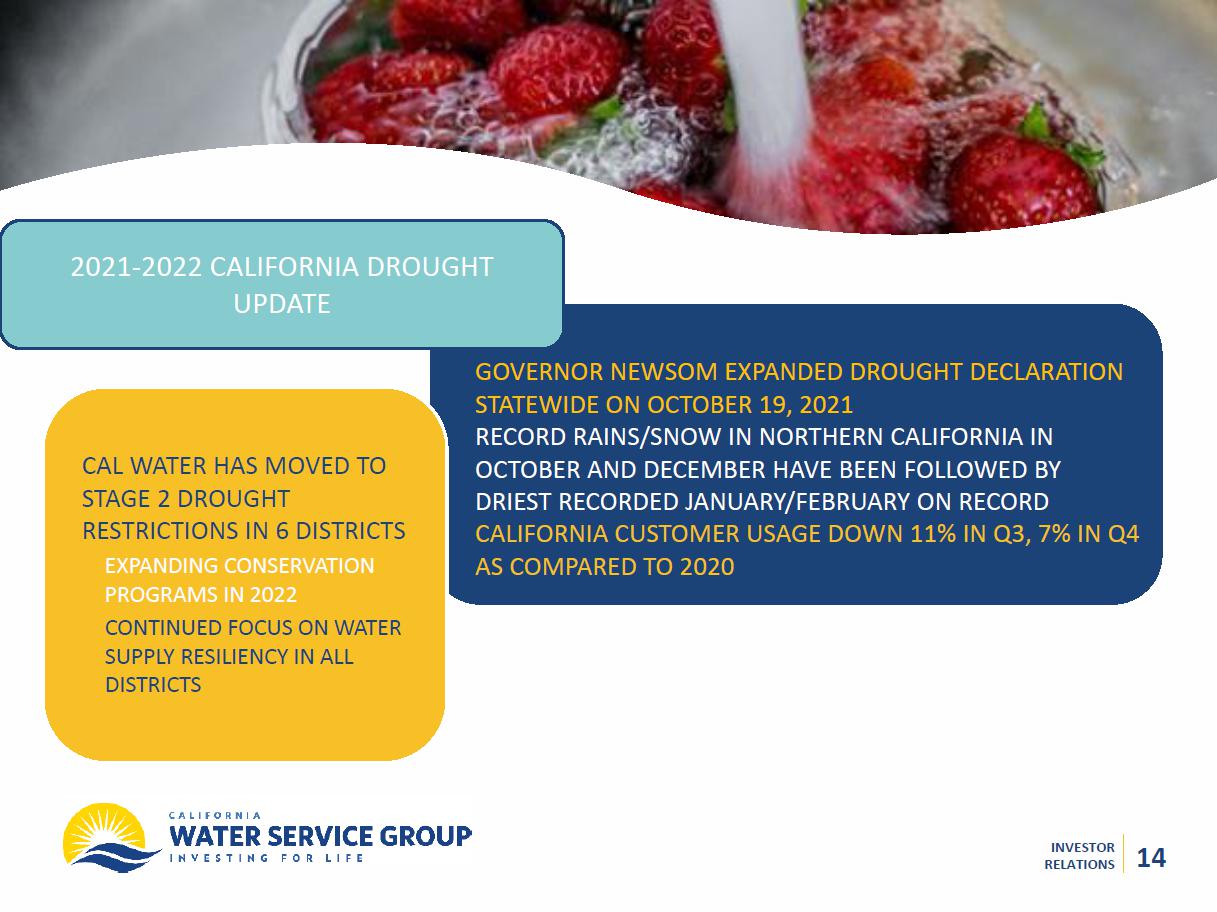

INVESTOR RELATIONS 2021 - 2022 CALIFORNIA DROUGHT UPDATE GOVERNOR NEWSOM EXPANDED DROUGHT DECLARATION STATEWIDE ON OCTOBER 19, 2021 RECORD RAINS/SNOW IN NORTHERN CALIFORNIA IN OCTOBER AND DECEMBER HAVE BEEN FOLLOWED BY DRIEST RECORDED JANUARY/FEBRUARY ON RECORD CALIFORNIA CUSTOMER USAGE DOWN 11% IN Q3, 7% IN Q4 AS COMPARED TO 2020 CAL WATER HAS MOVED TO STAGE 2 DROUGHT RESTRICTIONS IN 6 DISTRICTS EXPANDING CONSERVATION PROGRAMS IN 2022 CONTINUED FOCUS ON WATER SUPPLY RESILIENCY IN ALL DISTRICTS 14

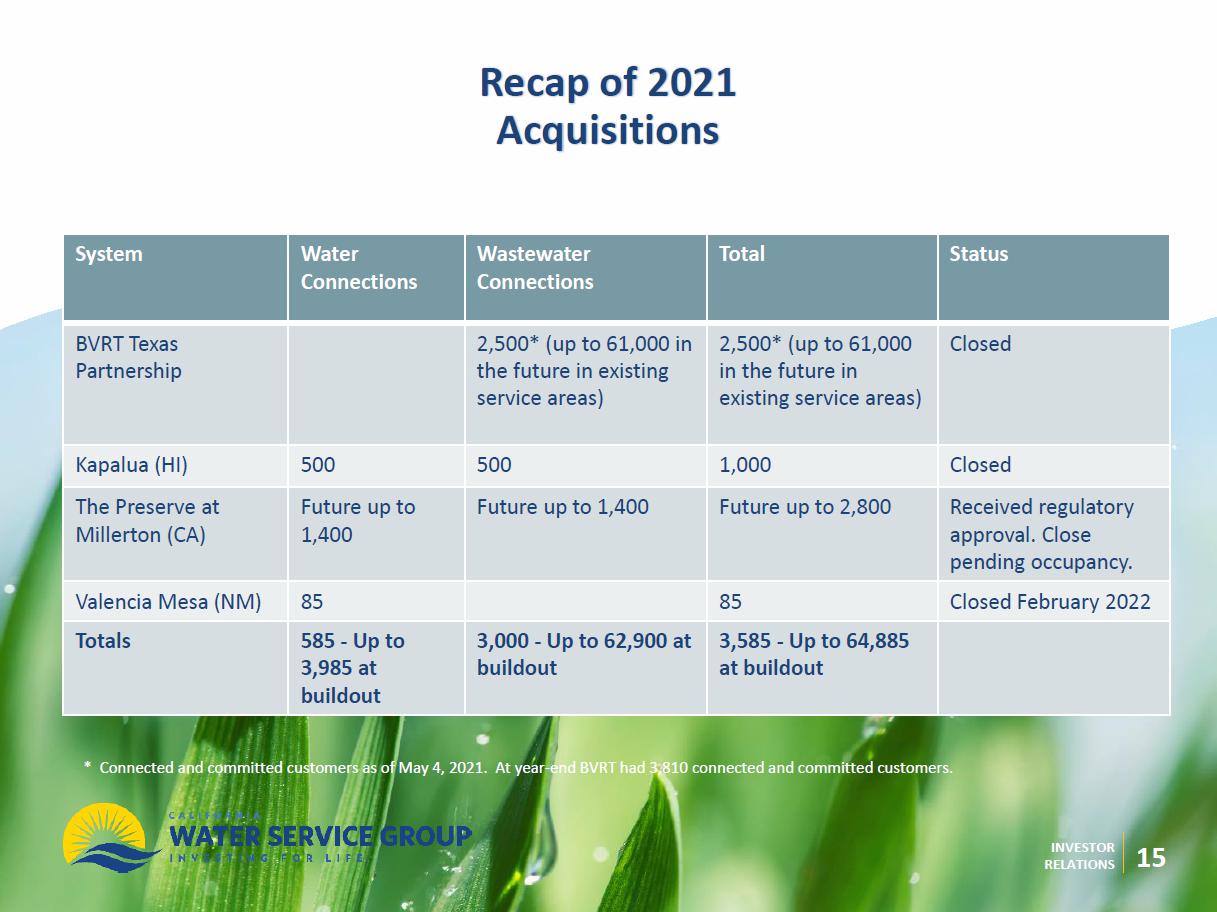

INVESTOR RELATIONS 15 Recap of 2021 Acquisitions System Water Connections Wastewater Connections Total Status BVRT Texas Partnership 2,500* (up to 61,000 in the future in existing service areas) 2,500* (up to 61,000 in the future in existing service areas) Closed Kapalua (HI) 500 500 1,000 Closed The Preserve at Millerton (CA) Future up to 1,400 Future up to 1,400 Future up to 2,800 Received regulatory approval. Close pending occupancy. Valencia Mesa (NM) 85 85 Closed February 2022 Totals 585 - Up to 3,985 at buildout 3,000 - Up to 62,900 at buildout 3,585 - Up to 64,885 at buildout * Connected and committed customers as of May 4, 2021. At year - end BVRT had 3,810 connected and committed customers.

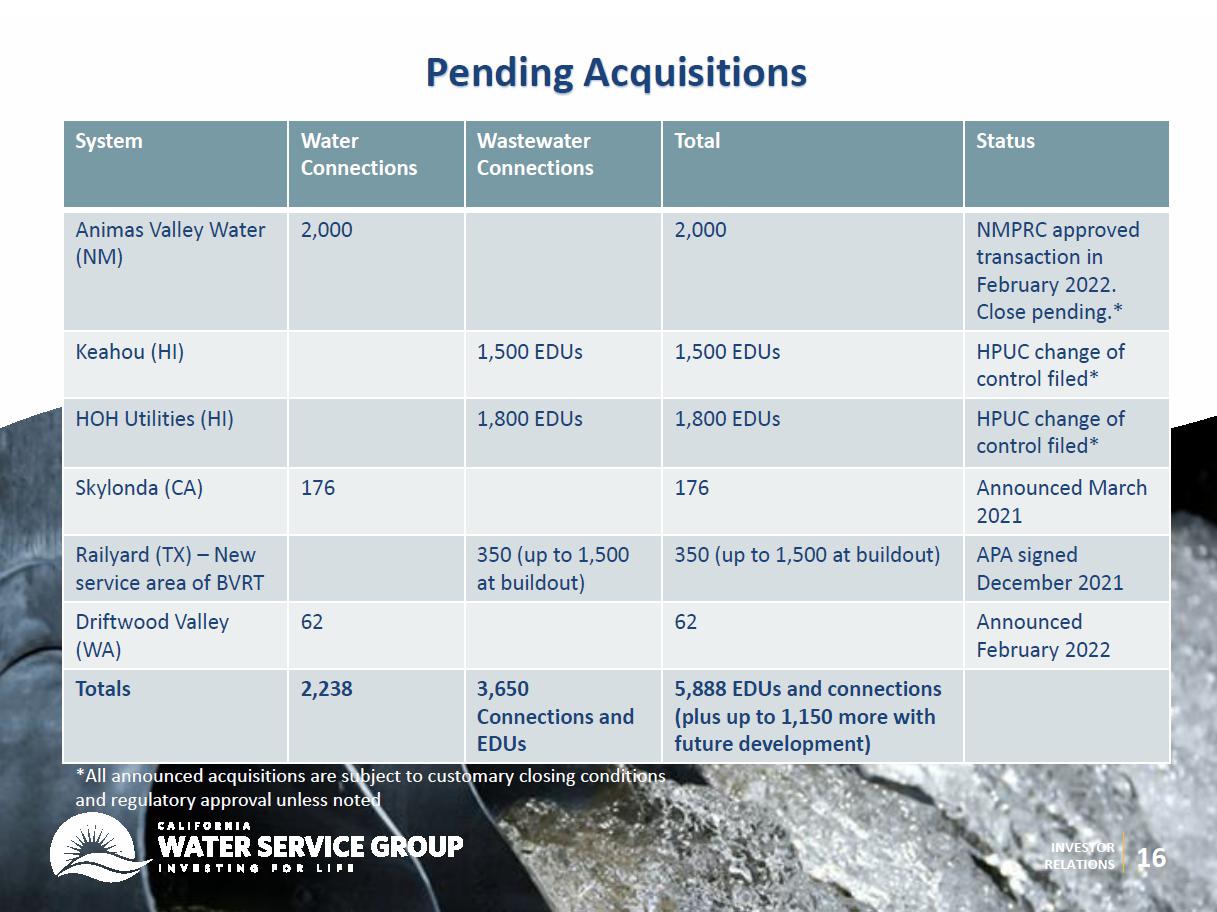

INVESTOR RELATIONS 16 Pending Acquisitions System Water Connections Wastewater Connections Total Status Animas Valley Water (NM) 2,000 2,000 NMPRC approved transaction in February 2022. Close pending.* Keahou (HI) 1,500 EDUs 1,500 EDUs HPUC change of control filed* HOH Utilities (HI) 1,800 EDUs 1,800 EDUs HPUC change of control filed* Skylonda (CA) 176 176 Announced March 2021 Railyard (TX) – New service area of BVRT 350 (up to 1,500 at buildout) 350 (up to 1,500 at buildout) APA signed December 2021 Driftwood Valley (WA) 62 62 Announced February 2022 Totals 2,238 3,650 Connections and EDUs 5,888 EDUs and connections (plus up to 1,150 more with future development) *All announced acquisitions are subject to customary closing conditions and regulatory approval unless noted

INVESTOR RELATIONS 17 2021 ESG Accomplishments Published first framework - aligned ESG Report o Aligned with SASB o Guided by TCFD Adopted four new ESG - related policies o Human Rights o Environmental Sustainability o Political Involvement o Diversity, Equality, and Inclusion Established ESG governance framework o Board level oversight: Nominating & Governance Committee o Officer level accountability: ESG Oversight Committee o Subject matter expert team: ESG Working Group Developed a climate change strategy o Reduce our own and our customers’ contributions to climate change o Understand & plan for climate change impacts on our business o Ramp up collaboration & advocacy o Set time - bound goals o Continue to mature disclosures Completed a robust ESG goal - setting process o Short - and long - term objectives o Based on collaboration by subject matter experts o Now integrated into strategic planning process OUR 2021 ESG REPORT WILL BE PUBLISHED IN APRIL

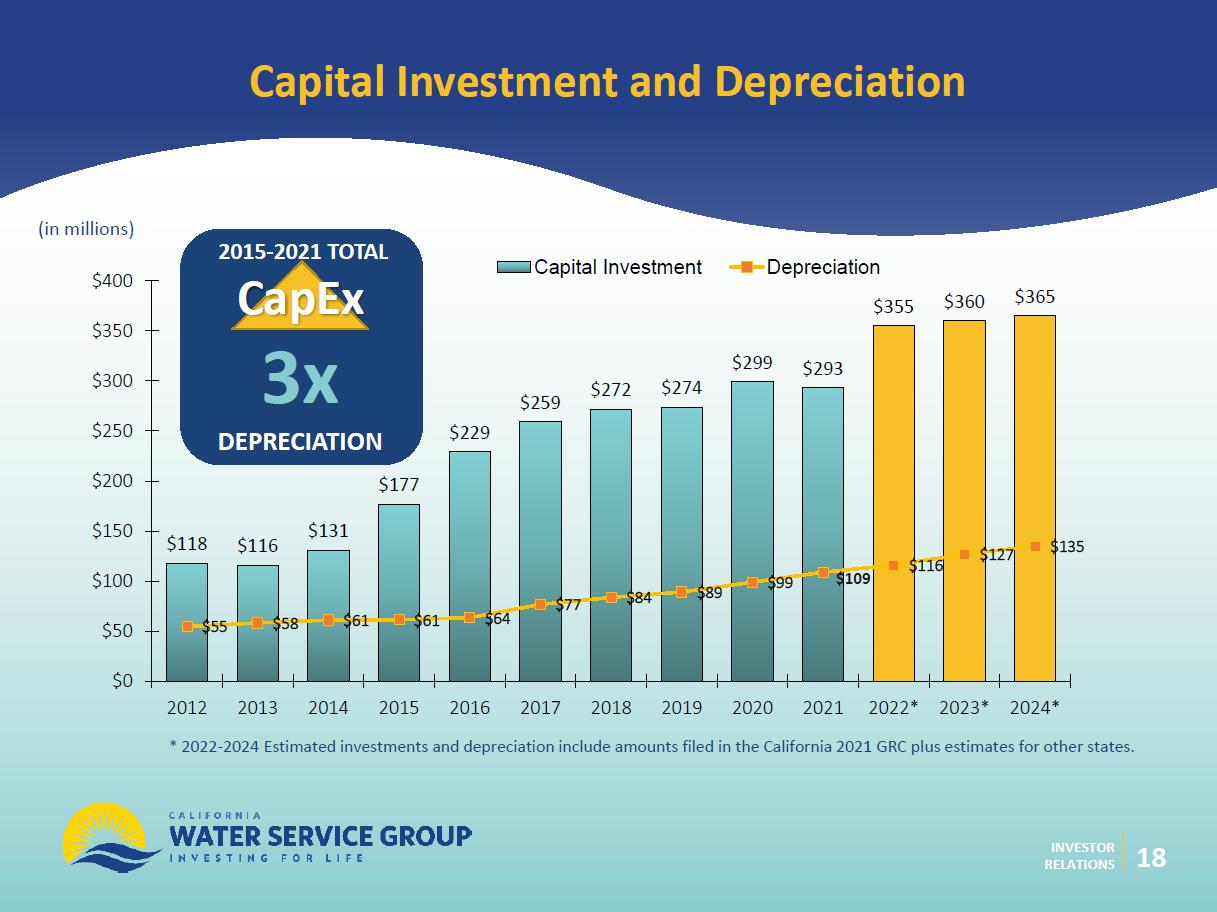

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $293 $355 $360 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $116 $127 $135 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022* 2023* 2024* Capital Investment Depreciation Capital Investment and Depreciation 18 (in millions) * 2022 - 2024 Estimated investments and depreciation include amounts filed in the California 2021 GRC plus estimates for other sta tes. 2015 - 2021 TOTAL CapEx 3x DEPRECIATION $109

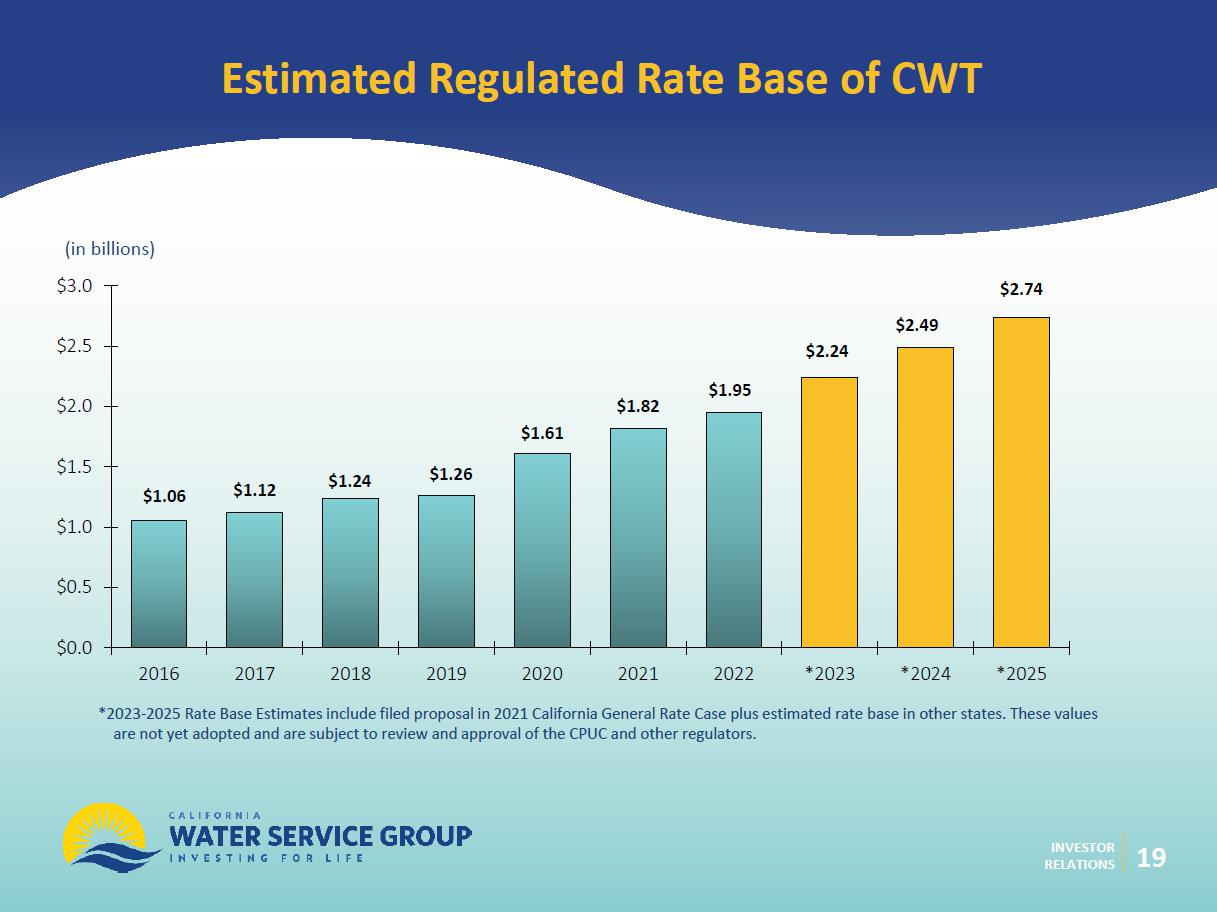

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions ) *2023 - 2025 Rate Base Estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other sta tes. These values are not yet adopted and are subject to review and approval of the CPUC and other regulators. 19 $1.06 $1.12 $1.24 $1.61 $2.74 $1.26 $ 1.82 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 *2023 *2024 *2025 $1.95 $2.24 $2.49

INVESTOR RELATIONS 20 2022 Business Priorities Resolve California GRC Resolve California Cost of Capital Invest in Infrastructure ESG Progress Respond to California Drought Manage Supply Chains

21 INVESTOR RELATIONS In Summary o Solid performance on earnings and CapEx despite challenges o Another strong year of business development o Looking forward to resolving major regulatory proceedings in 2022 and managing our response to the California drought

DISCUSSION