EXHIBIT 99.2

Published on October 28, 2021

Exhibit 99.2

0 Third Quarter 2021 Results Presentation October 28, 2021

INVESTOR RELATIONS Forward - Looking Statements 1 This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("Act"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatme nt established by the Act. Forward - looking statements are based on currently available information, expectations, estimates, assumptions and projectio ns, and management's judgment about the Company, the water utility industry and general economic conditions. Such words as would, expects, intends , p lans, believes, may, estimates, assumes, anticipates, projects, predicts, targets, forecasts or variations of such words or similar expressions ar e i ntended to identify forward - looking statements. The forward - looking statements are not guarantees of future performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from what is contained in a forward - looking statement. Factors that may cause a result different than expected or anticipated include, but are not limited to: the impact of the ongoing COVID - 19 pandemic and related public health m easures; our ability to invest or apply the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commission s' decisions, including decisions on proper disposition of property; consequences of eminent domain actions relating to our water systems; changes in re gulatory commissions' policies and procedures, including discontinuance of WRAM in the next GRC filing (which may impact operations commencing in 2 023 ); the outcome and timeliness of regulatory commissions' actions concerning rate relief and other matters; increased risk of inverse condemnatio n l osses as a result of climate conditions; inability to renew leases to operate water systems owned by others on beneficial terms; changes in Califo rni a State Water Resources Control Board water quality standards; changes in environmental compliance and water quality requirements; electric power int err uptions; housing and customer growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; is sue s with the implementation, maintenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cyber security risks and threats; the ability of our enterprise risk management processes to identify or address ri sks adequately; labor relations matters as we negotiate with the unions; changes in customer water use patterns and the effects of conservation; ou r a bility to complete, successfully integrate and achieve anticipated benefits form announced acquisitions; the impact of weather, climate, natural dis asters, and actual or threatened public health emergencies, including disease outbreaks, on our operations, water quality, water availability, wate r s ales and operating results and the adequacy of our emergency preparedness; restrictive covenants in or changes to the credit ratings on our curr ent or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; and, other risks and unforeseen events. When considering forward - looking statements, you should keep in mind the cautionary statements included in this paragraph, as we ll as the annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchange Commission (SEC). The Company assu mes no obligation to provide public updates of forward - looking statements.

INVESTOR RELATIONS Today’s Participants Marty Kropelnicki President & CEO Tom Smegal Vice President, CFO & Treasurer Paul Townsley Vice President, Corporate Development and Chief Regulatory Officer 2 Dave Healey Vice President, Controller

3 INVESTOR RELATIONS Presentation Overview o Our Operating Priorities o Financial Results and EPS Bridges o Earnings Notes o Regulatory Update o Drought o Continuing COVID - 19 Impacts o Business Development Update o Cap Ex and Rate Base Tables o In Summary

INVESTOR RELATIONS 4 Our Operating Priorities Affordable, Excellent Service o Continuous improvement, efficient innovation o Technology as enabler o Centralized platform & process standardization o Clear & effective communications High - Quality Water & Wastewater o Consistent sampling & rigorous monitoring o Use of best available treatment & testing technologies Employees as Best Advocates o Safe workplace & healthy lifestyles o Professional development o Effective, transparent communication o Teamwork Strong Brand & Reputation o Environmental stewardship o Community involvement & leadership o Water conservation leadership o Communication & corporate governance Enhanced Stockholder Value o Infrastructure investment o Growth by criteria & for long term ( organic/M&A/ innovative partnerships) o Risk management o Progressive regulatory management o Effective investor relations

INVESTOR RELATIONS 5 Financial Results: YTD 2021 (Amounts are in millions, except for EPS) YTD 2020 YTD 2021 Variance Operating Revenue $605.2 $617.6 2.1% Operating Expenses $493.5 $501.3 1.6% Net Interest Expense $30.8 $31.9 3.5% Net In come $81.3 $97.5 19.9% EPS $1.66 $1.91 15.1% Capital Investments $221.3 $207.7 (6.1%)

INVESTOR RELATIONS 6 Financial Results: Third Quarter 2021 (Amounts are in millions, except for EPS) Q3 2020* Q3 2021 Variance Operating Revenue $304.1 $256.7 (15.6%) Operating Expenses $198.0 $185.6 (6.3%) Net Interest Expense $10.5 $11.2 7.1% Net In come $96.4 $62.5 (35.1%) EPS $1.94 $1.20 (38.0%) Capital Investments $87.8 $69.2 (21.1%) *Includes effect of delayed 2018 GRC rate increases and regulatory mechanisms which would have been reflected in periods prio r t o Q3 2020 with a timely decision

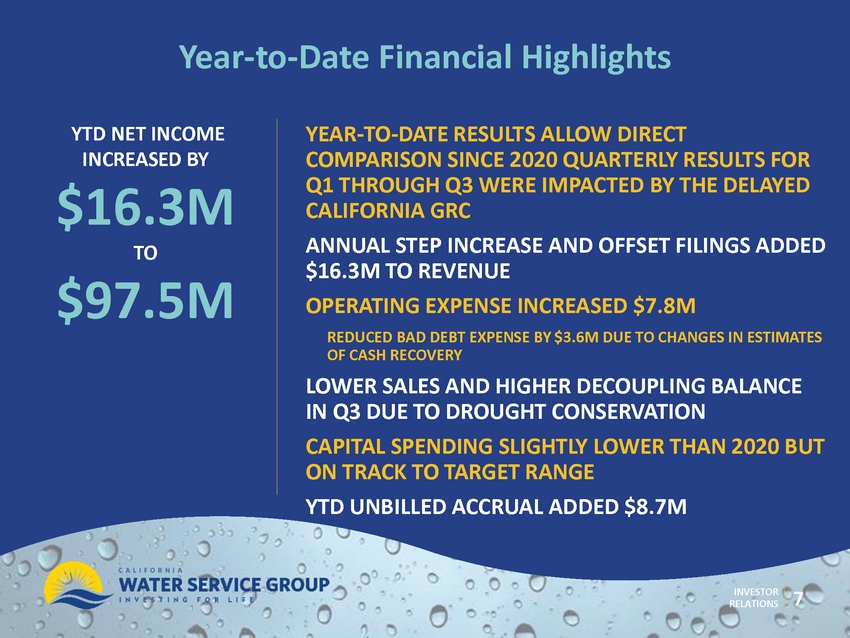

INVESTOR RELATIONS 7 YEAR - TO - DATE RESULTS ALLOW DIRECT COMPARISON SINCE 2020 QUARTERLY RESULTS FOR Q1 THROUGH Q3 WERE IMPACTED BY THE DELAYED CALIFORNIA GRC ANNUAL STEP INCREASE AND OFFSET FILINGS ADDED $16.3M TO REVENUE OPERATING EXPENSE INCREASED $7.8M REDUCED BAD DEBT EXPENSE BY $3.6M DUE TO CHANGES IN ESTIMATES OF CASH RECOVERY LOWER SALES AND HIGHER DECOUPLING BALANCE IN Q3 DUE TO DROUGHT CONSERVATION CAPITAL SPENDING SLIGHTLY LOWER THAN 2020 BUT ON TRACK TO TARGET RANGE YTD UNBILLED ACCRUAL ADDED $8.7M Year - to - Date Financial Highlights YTD NET INCOME INCREASED BY $16.3M TO $97.5M

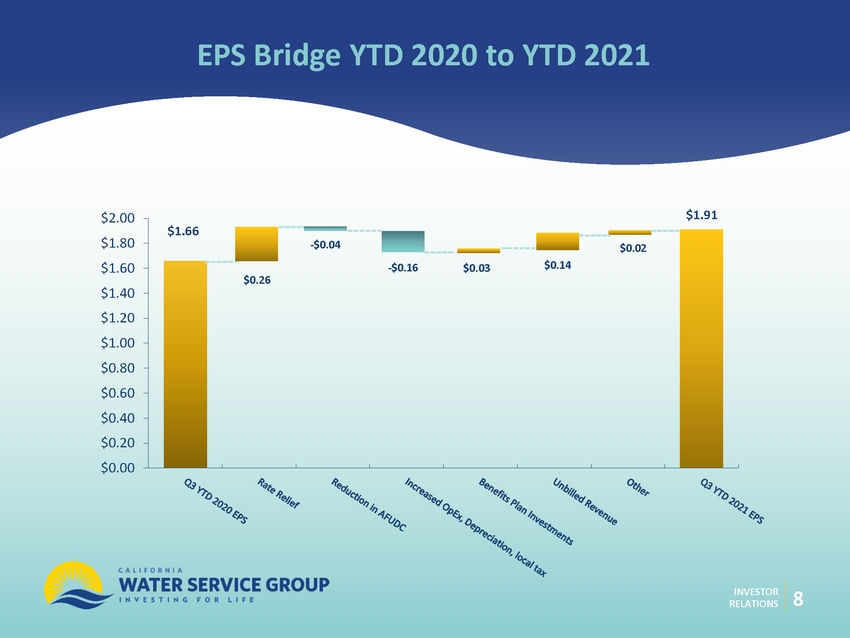

INVESTOR RELATIONS EPS Bridge YTD 2020 to YTD 2021 8 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $0.02 - $0.04 $0.03 $0.14 $1.66 - $0.16 $0.26 $1.91

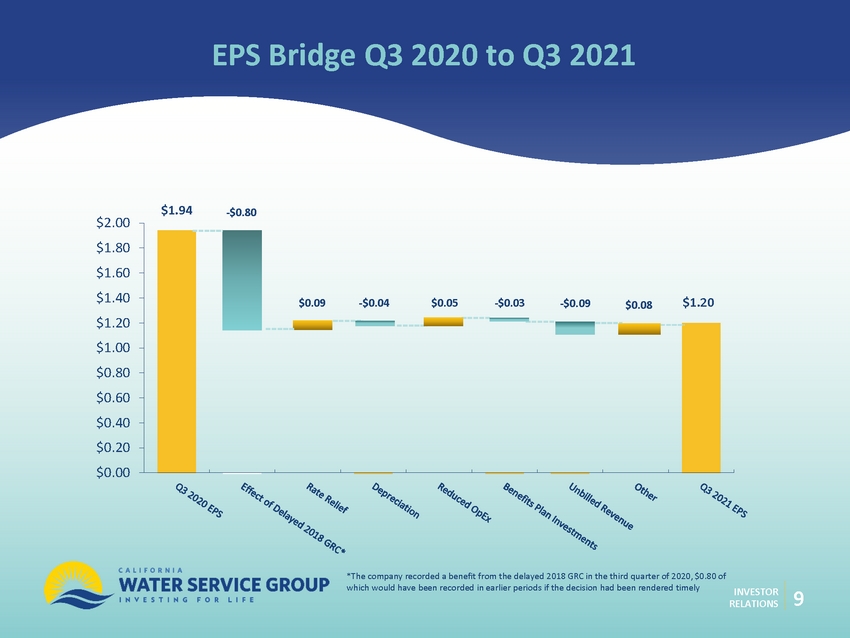

INVESTOR RELATIONS EPS Bridge Q3 2020 to Q3 2021 9 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $0.08 $0.09 $0.05 $1.94 - $0.04 - $0.03 - $0.80 $1.20 *The company recorded a benefit from the delayed 2018 GRC in the third quarter of 2020, $0.80 of which would have been recorded in earlier periods if the decision had been rendered timely - $0.09

INVESTOR RELATIONS 10 Earnings Notes As we approach year - end, keep in mind items introduced on prior calls: • Authorized rate base for all operations is $1.82B and a general guide to earnings is to calculate the authorized return on the equity portion of rate base • Other items which may impact earnings outside the authorized return on rate base are: • Income from recognition of equity AFUDC is $2.3M in YTD 2021. • Unrealized gain on nonqualified retirement assets is $2.1M in 2021 to date. The value of these assets is market - driven and year - end values will be based on market conditions. • Bad debt reserve has been reduced from $5.2M at the end of 2020 to $2.8M reflecting changes in estimates of cash recovery. Unbilled revenue accrual is currently adding $20.1M to revenue as compared to $11.4M at this time in 2020. Investors should not assume significant gains from unbilled revenue for the full year.

INVESTOR RELATIONS 11 WASHINGTON GRC INTEGRATING RAINIER VIEW ACQUISITION FILED IN Q3, ANTICIPATE A DECISION BEFORE Q2 2022 Regulatory Update CALIFORNIA GENERAL RATE CASE FILED JULY 1: ON SCHEDULE WITH INTERVENOR TESTIMONY EXPECTED IN Q1 2022 CALIFORNIA COST OF CAPITAL FILED MAY 1: PROGRESS IS SLOW WITH INTERVENOR TESTIMONY EXPECTED IN Q4 AND A DECISION IN Q2 2022 CPUC HAS APPROVED TRACKING DROUGHT COSTS IN A MEMORANDUM ACCOUNT FOR FUTURE RECOVERY

INVESTOR RELATIONS 2021 CALIFORNIA DROUGHT UPDATE GOVERNOR NEWSOM EXPANDED DROUGHT DECLARATION STATEWIDE ON OCTOBER 19 HEAVY RAINS IN NORTHERN CALIFORNIA LAST WEEK PROVIDED SOME RELIEF BUT ONLY A WET, SNOWY WINTER WILL END DROUGHT RISK FOR 2022 CALIFORNIA CUSTOMER USAGE DOWN 11% IN Q3 CAL WATER HAS MOVED TO STAGE 2 DROUGHT RESTRICTIONS IN 6 DISTRICTS WATER BUDGETS POSSIBLE IN 2022 IF DROUGHT CONTINUES CONTINUED FOCUS ON WATER SUPPLY RESILIENCY IN ALL DISTRICTS 12

13 INVESTOR RELATIONS Continuing Impacts from Covid - 19 Pandemic All company employees have returned to the office. We continue to be vigilant for employee and customer safety; we encourage and incentivize vaccination; and we follow local masking rules and recommendations as applicable. New Mexico, Washington, and Hawaii have allowed us to restart bill collection processes with some restrictions. California moratorium expected to continue at least through 2021 . At the end of Q3, i ncreased customer account aging from suspension of collection activities o Bills outstanding >90 days increased to $16.6M o Reduced reserve for doubtful accounts from $6.4M as of June 30, 2021 to $2.8M due to changes in estimates of cash recovery. Incremental COVID - 19 - related expenses in Q3 of $0.2M and $1.4M for the pandemic to date ; anticipate filing for recovery in 2022 in CA. Liquidity remains strong; at quarter - end, $140.4M cash and additional current capacity of $420M on lines of credit, subject to meeting borrowing conditions.

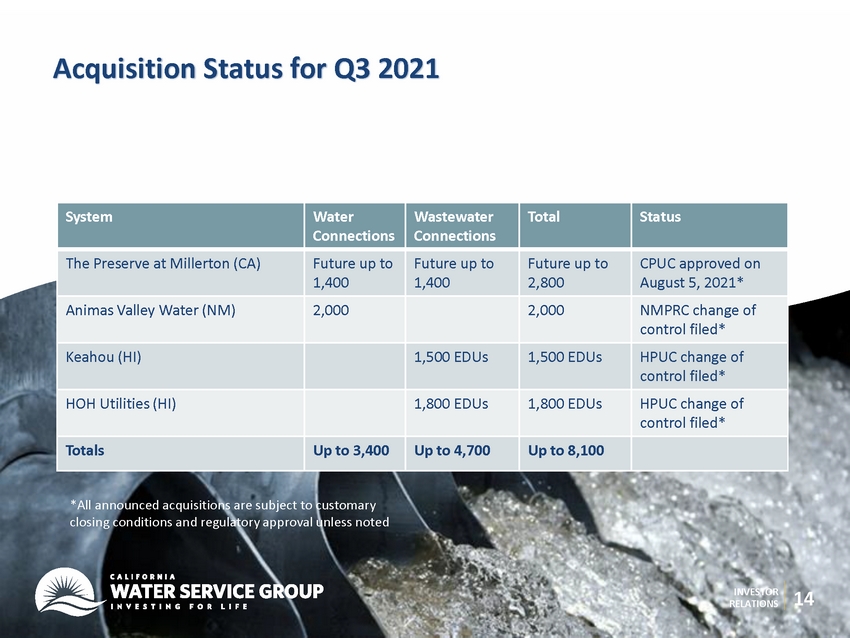

INVESTOR RELATIONS 14 Acquisition Status for Q3 2021 System Water Connections Wastewater Connections Total Status The Preserve at Millerton (CA) Future up to 1,400 Future up to 1,400 Future up to 2,800 CPUC approved on August 5, 2021* Animas Valley Water (NM) 2,000 2,000 NMPRC change of control filed* Keahou (HI) 1,500 EDUs 1,500 EDUs HPUC change of control filed* HOH Utilities (HI) 1,800 EDUs 1,800 EDUs HPUC change of control filed* Totals Up to 3,400 Up to 4,700 Up to 8,100 *All announced acquisitions are subject to customary closing conditions and regulatory approval unless noted

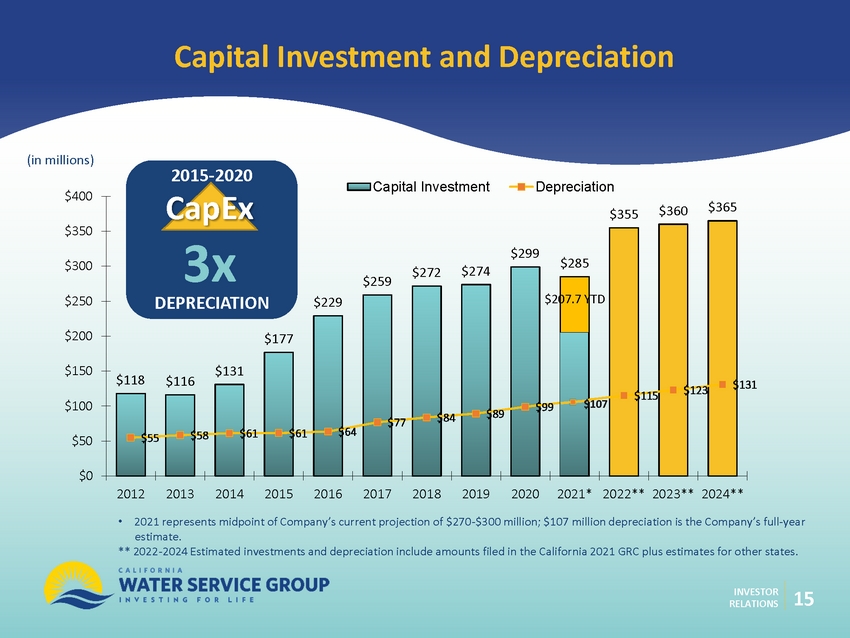

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $285 $355 $360 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $115 $123 $131 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021* 2022** 2023** 2024** Capital Investment Depreciation $207.7 YTD Capital Investment and Depreciation 15 (in millions) • 2021 represents midpoint of Company’s current projection of $270 - $300 million; $107 million depreciation is the Company’s full - year estimate. ** 2022 - 2024 Estimated investments and depreciation include amounts filed in the California 2021 GRC plus estimates for other st ates. 2008 - 2019 CAGR 9.7% 2015 - 2020 CapEx 3x DEPRECIATION $107

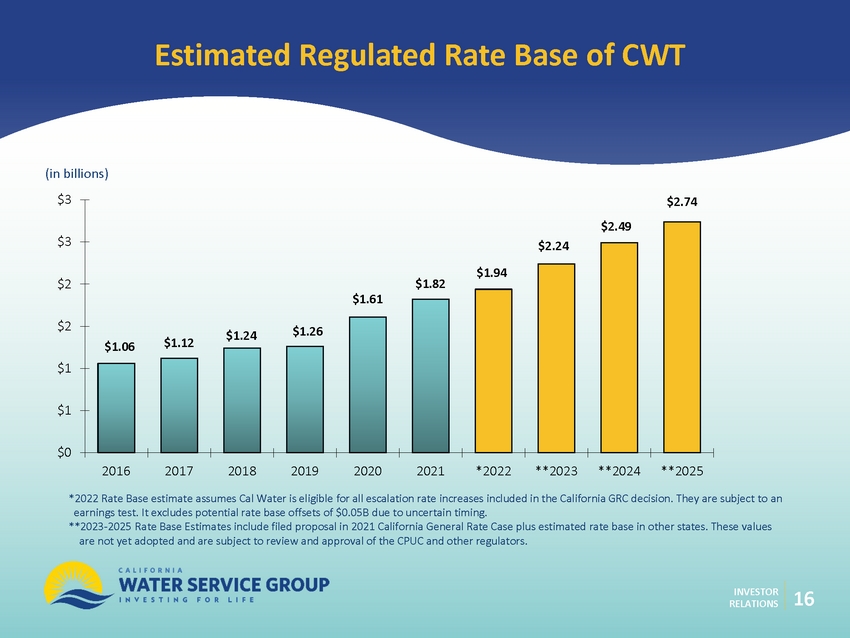

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions ) * 2022 Rate Base estimate assumes Cal Water is eligible for all escalation rate increases included in the California GRC decision. They are subject to an earnings test . It excludes potential rate base offsets of $0.05B due to uncertain timing. **2023 - 2025 Rate Base Estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other st ates. These values are not yet adopted and are subject to review and approval of the CPUC and other regulators. 16 $1.06 $1.12 $1.24 $1.61 $2.74 $1.26 $ 1.82 $0 $1 $1 $2 $2 $3 $3 2016 2017 2018 2019 2020 2021 *2022 **2023 **2024 **2025 $1.94 $2.24 $2.49

17 INVESTOR RELATIONS In Summary o Q3 r esults were in line with our expectations, and we are excited that state aid will come to our customers who had difficulty during the pandemic. o CPUC filings are ongoing with no material developments in the quarter. o The team is working on regulatory approval and integration of multiple acquisitions across our platform. o On our next quarterly call we should have a good idea of drought severity in California in 2022.

DISCUSSION